The trial balance showed wages, N2 500 and a note stated that N500 wages, were due but unpaid when preparing final accounts and loss account with

- A. N 3000 and show wages accrued N 500 in the balance sheet in the balance sheet

- B. N 2 000 and show wages accured N500 in the balance sheet

- C. N 3000 and show wages prepaid N 500 in the balance sheet

- D. N 2000 and show wages paid in advance N 500 in the balance sheet

What was the balance showed wages, N2 500 and a note stated that N 500 wages were due but unpaid when preparing final accounts and loss account with

- A. N 3 000 and show wages accrued N 500 in the balance sheet

- B. N2 000 and show wages accrued N500 in the balance sheet

- C. N 3 000 and show wages perpaid N 500 in the balance sheet

- D. N 2000 and show wages paid in advance N500 in the balace sheet

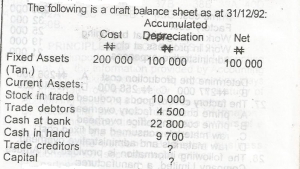

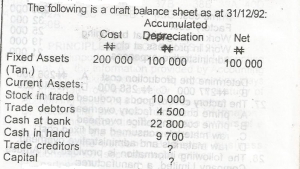

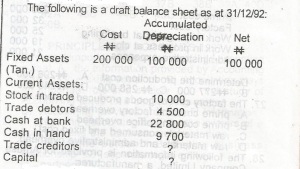

Trade creditors account was maintained at 25% of the capital.

What was the balance in the trade creditors account as at 31/12/92?

- A. N 29 800

- B. N 29 500

- C. N29 400

- D. N 29 000

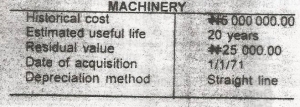

THE BOOK VALUE OF THE ASSET AS AT 31/12/86 WAS

- A. N 3 731 250.00

- B. N 2 487 500.00

- C. N 1 268 750.00

- D. N1 020 000. 00

Accumulated depreciation on the asset as at 31/12/81 was

- A. N 2 487 500 .00

- B. N 2 736 250 . 00

- C. N 4 511 192.00

- D. N 4 975 000 .00

A charitable club has the following figures:

N

Subscriptions received in 1991 2 800

Subscriptions unpaid in 1990 300

Subscriptions paid for 1992 150

Subscriptions due 1991 180

How much should be charged to the income and expenditure of this club as subscription for 1991?

- A. N 2 530

- B. N 2 680

- C. N 2 830

- D. N 2 980

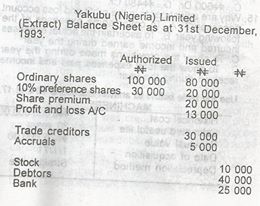

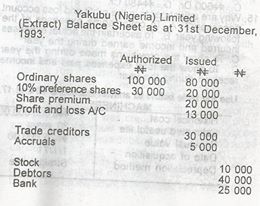

If a 10% dividend is approved, what is the dividend payable to ordinary shareholders?

- A. N 13 000

- B. N 11 300

- C. N 10 000

- D. N 8 000

Equity shareholders’ fund is

- A. N133 000

- B. N 120 000

- C. N113 000

- D. N 100 000

A government accounting systems must make sure that

- A. revenue exceeds expenditure

- B. all applicable legal provisions are complied with

- C. capital expenditure is equal to revenue

- D. capital project fund is tied to recurrent expenditure

Eko Local Government expenditure

Hospital building ———————- N200,000

Drugs ———————————- N180,000

Hospital beds and mattresses ———— N40,000

Doctors’ and nurses’ salaries ———- N120,000

Administrative expenses —————– N50,000

Recurrent expenditure is

- A. N390,000

- B. N360,000

- C. N350,000

- D. N170,000

Eko Local Government expenditure

Hospital building ———————- N200,000

Drugs ———————————- N180,000

Hospital beds and mattresses ———— N40,000

Doctors’ and nurses’ salaries ———- N120,000

Administrative expenses —————– N50,000

Capital expenditure is

- A. N420,000

- B. N380,000

- C. N240,000

- D. N200,000

Which of the following are sources of revenue to state government in Nigeria?

I Statutory allocation

II Fines from customary courts

III Petroleum tax

IV Income tax

IV

- A. I and II only

- B. II and III

- C. I and IV

- D. III and IV

Which of the following statement is correct about the head office current account and the branch current account?

- A. Both always have debit balances

- B. both always have credit balances

- C. the head office current account has a credit balance while the branch current account has a debit balance

- D. the head office current account has a debit balance while the branch current account has a credit balance

The Asa branch of Emene company Ltd, made a sales of N549,000 from the goods sent from the head office during the period ended 31/12/94. These sales were based on a 22% mark up. If branch expenses were N34,400 and there were no discrepancies, what should be the profit of the branch for the period?

- A. N6,500

- B. N64,600

- C. N85,380

- D. N514,600

Departmental accounts re maintained to ascertain the

- A. profits of the entire organization

- B. contribution of each department

- C. expenses of each department

- D. sales of each department

The measure of a company’s ability to pays its debts quickly is called

- A. Current ratio

- B. turnover ratio

- C. acid test ratio

- D. return of investment

A total of 400,000 shares of N1 each are to be issued by Sariki company Ltd at a price of N1.20 per share. Application were received for 600,000 shares out of which 100,000 were dishonored. If the available share were distributed pro-rata, what refund will be due a subscriber who applied for 5,000 shares?

- A. N1,000

- B. N1,200

- C. N4,800

- D. N6,000

Which of the following ratios gives an idea of the liquidity of a firm?

- A. Turnover ratio

- B. Quick ratio

- C. Debit ratio

- D. Dividend yield

The conversion of a partners business into a limited liability company affords the

- A. general partners the chance of enjoying the limited laibility protection

- B. limited liability partners the chance of enjoying the limited liability protecction

- C. Creditors the chance of enjoying the limited liabiity protection

- D. debtors the chance of enjoying the limited liability protection

Halidu and Hamed are business partners with N30,000 and N20,000 capital respectively. At the end of the financial year, a profit of N12,000, which included Halidu’s salary of N3,000 was made.

Hamed’s share of the profit should be

- A. credited to partners' capital account

- B. credited to partners' current account

- C. credited to appropriation account

- D. debited to partners' drawing account

Halidu and Hamed are business partners with N30,000 and N20,000 capital respectively. At the end of the financial year, a profit of N12,000, which included Halidu’s salary of N3,000 was made.

Halidu’s share of the profit is

- A. N7,500

- B. N6,000

- C. N5,400

- D. N4,500