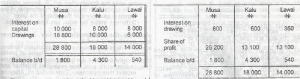

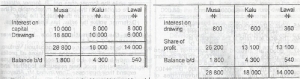

The Current account above had some errors in the arrangement of the accounts for Musa, Kalu and Lawal]

The correct closing balance for lawal’s current account is

- A. N21 100 debit

- B. N14 740 debit

- C. N14 740 credit

- D. N540 credit

The Current account above had some errors in the arrangement of the accounts for Musa, Kalu and Lawal

The Correct closing balance for Musa’s current account is

- A. N36 000 Credit

- B. N16 600 credit

- C. N16 600 debit

- D. N1 800 credit

The end result of governmental accounting procedure is to

- A. keep proper records of government expenditures

- B. give financial information to the public and investors

- C. produce timely and accurate financial reports for legislators and the public

- D. give information on the performance of public enterprises

Public sector accounting is based on

- A. cash

- B. accrual

- C. budget

- D. consolidated fund

Which of the following are advantages of departmental accounts?

I. The department making the highest profit can be easily determined

II. The capital of the business can be calculated easily

III. Easy knowledge of the sources of funding

IV. Encouragement of healthy rivalry among the various departments

- A. I and IV only

- B. II and III only

- C. II and IV only

- D. III and IV only

If goods are invoiced to the branch at cost and the invoice par value is N 2 000 with 5%discount rate, can remitted to the head office is

- A. N2 100

- B. N 200

- C. N 1 900

- D. N 100

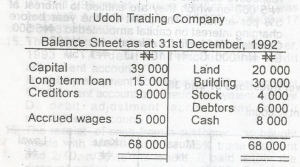

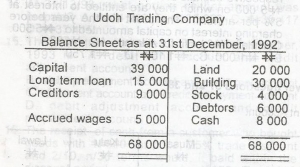

What is the working capital?

- A. N12 000

- B. N 11 000

- C. N 8 000

- D. N4 000

A dividend of 10% in a company on 500 000 ordinary shares of N 1 nominal value has been declared, How much will a shareholder receive if he has 200 shares?

- A. N 500 000

- B. N 50 000

- C. N200

- D. N 20

A company has 5% debentures worth N500 000 ordinary share capital N 2 000 000, and preference shares N1500 000. if the company made a profit of N 1 000 000, the debenture interest would amount to

- A. N 1 000 000

- B. N 500 000

- C. N 50 000

- D. N 25 000

On partnership dissolution, if a partner’s capital account has a debit balance and the partnr is insolvent, the deficiency will, in accordance with the decision of the case of Garner v Murray, be

- A. borne by all the partners

- B. borne by the insolvent partner

- C. written off

- D. borne by the solvent partners

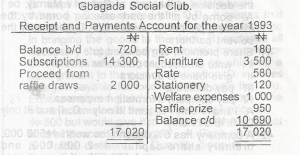

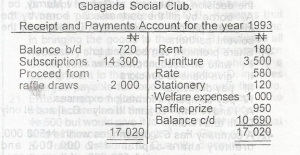

Accumulated fund on 1st January 1993 is

- A. N 8 570

- B. N8 470

- C. N 850

- D. N7 520

Additional information :

1: 1: 93 31 : 12 : 93

N N

Subscription in arrears 300 450

Furniture 7000

Subscription received

in advance 500 400

Rate owing 50 60

Subscription relating to the accounting year 1993 in the income and expenditure account is

- A. N 15 050

- B. N 14 550

- C. N14 300

- D. N 13 400

An income and expenditure account is a summary of

- A. all income and expenditure during a period

- B. revenue income and expenditure during a period

- C. receipts and payments during a period

- D. the trading income a period

The difference between a trading account and a manufacturing account is that while the manufacturing account

- A. has no particular period, the trading account has

- B. does not consider the cost of goods involved, the trading account does

- C. is concerned with the cost of production, the trading account is not

- D. is not concerned with the stock of raw materials the rading account is

Given: N

Direct material – 10 000

Direct labour – 5000

Direct expenses – 2000

Factory overhead – 4000

What is the prime cost?

- A. N21 000

- B. N 17 000

- C. N 15 000

- D. N 6 000

In analyzing incomplete records, which of the following should be investigated?

- A. the general ledger

- B. the purchases day book and sales day book

- C. the nature of trading activities and the basis on which goods are sold

- D. the asset register together with the depreciation schedule

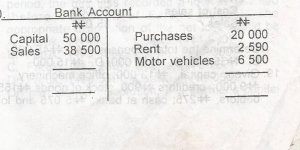

What is the balance of the bank account shown above?

- A. N88 500 debit

- B. N 88 500 credit

- C. N 59 410 credit

- D. N 59 410 debit

Alabede (NIG) limited issued 50 000 ordinary shares of N1 each at a market value of N2.50 each. the share premium is?

- A. N125 000

- B. N500 000

- C. N50 000

- D. N25 000

Share premium can be used to?

i. write off discount on shares

ii. give loans to directors

iii.pay dividends

iv. pay company’s formation expenses.

- A. i and iv only

- B. i and iii only

- C. ii and iii only

- D. iii and iv only

Faruk and Osawe are in partnership sharing profits and losses in the ratio of 3:7. Faruk is to receive a salary of N9 000. In one accounting period, the business recorded a loss of N1 500 (before deduction of Faruk’s salary). The appropriate distribution of the net loss would be?

- A. Faruk, (N450); Osawe, (N1 050)

- B. Faruk, (N3 150); Osawe, (N7350)

- C. Faruk, (2 250); Osawe, (N7 350)

- D. Faruk, (N450); Osawe, (N1 050)