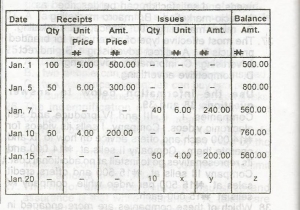

WHAT IS THE STOCK VALUATION METHOD USED?

- A. LAST IN FIRST OUT

- B. FIRST IN FIRST OUT

- C. AVERAGE COST

- D. WEIGHTED AVERAGE

Given:

N N

Capital 200,000 total assets 210,000

Liabilities 10,000

210,000 210,000

If the business is purchased at a price including a goodwill of N 20,000, what must have been the purchas price?

- A. N190,000

- B. N210,000

- C. N220,000

- D. N230,000

» Given:

PTF Trial Balance [Extract] as at 31 December, 1999

Dr Cr

N’000 N ‘000

Cash 2,000

Investments 3,000

Accounts receivable 6,000 11,000

Fund balance 11,000 11,000

If only 1/2 of the investments is sold for N2m and N5m realized from the accounts receivable what will be the balance of the fund?

- A. N9M

- B. N11M

- C. N13M

- D. N16M

Given:

PTF Trial Balance [Extract] as at 31 December, 1999

Dr Cr

N’000 N ‘000

Cash 2,000

Investments 3,000

Accounts receivable 6,000 11,000

Fund balance 11,000 11,000

Assuming all the investments realized N4m, what will be the endig fund balance?

- A. N8m

- B. N 11M

- C. N12M

- D. N15M

» Given:

Authorized Capital: N

100,000 ordinary shares of N 1 eash

Issued and fully paid:

50,000 ordinary shares of N 1 each 50,000

10, 000 8% perference shares

of N 1 each

Reserves 10,000

Creditors 25,000

Debtors 13 000

Cash in hand 5000

Calculate the shareholders fund

- A. N 60,000

- B. N75,000

- C. N85,000

- D. N185,000

Given:

Authorized Capital: N

100,000 ordinary shares of N 1 eash

Issued and fully paid:

50,000 ordinary shares of N 1 each 50,000

10, 000 8% perference shares

of N 1 each

Reserves 10,000

Creditors 25,000

Debtors 13 000

Cash in hand 5000

Determine the net current assets

- A. N 43,000

- B. N 28,000

- C. N13,000

- D. N3,000

Use the information below to answer question

Given: 31/12/98 31/12/99

Assets: Plant and Mach. N1,500 N1,200

Fixtures N700 N520

Stock N500 N600

Debtors N900 N400

Cash N200 N300

Liabilities: Creditor N500 N600

Loan N600 N400

What is the capital from the opening balance sheet?

- A. N3,600

- B. N 2,700

- C. N2,070

- D. N1,520

The officer responsible for ascertaining whether all public expenditure and appropriation are in line with approved guidelines is the?

- A. Acountant General

- B. Auditor General

- C. Finance Minister

- D. Permanent Secretary

The correct entry to reflect the receipt of cash sent by a branch to a head office is?

- A. debit cash and credit branch current account

- B. debit branch, current account and credit cash

- C. credit branch, debtors and debit cash

- D. credit branch current account and debit branch debtors

To account for expenses paid by head office on behalf of the branch, the branch should?

- A. debit head office account and credit cash

- B. debit profit and loss account and credit headoffice account

- C. credit cash and debit profitand loss account

- D. credit profit and loss account and debit head office account

Department F transferred some goods to department G at a selling price. The goods were not sold at the end of the accounting period. Which account is affected at the time of preparing a combined balance sheet?

- A. creditors

- B. debtors

- C. stock

- D. suspense

X and Y are two departments that are to share 50% of all joint costs equally and the balance in ratio 2:1. If a sum of N150,000 is incurred jointly, what will be the portion attributable to X?

- A. N37,500

- B. N62,500

- C. N87,500

- D. N100,000

The law that currently regulates the registration of companies in Nigeria is the?

- A. Constitution of the Federal Republic of Nigeria, 1999

- B. Nigeria Enterprises Promotion Decree, 1972

- C. Companies and Allied Matters Decree, 1990

- D. Companies Decree, 1968

The main difference between the ordinary and preference shareholders is that?

- A. the former receive dividends while the latter do not

- B. the latter are not members of the company while the former are

- C. in the case of winding up, the former are paid first before the latter

- D. the former have voting rights while the latter do not

Where a company acquires controlling shares of another and the consideration is paid in cash, the entries in the books of the purchases are debit?`

- A. investment and credit cash

- B. investment and credit shares

- C. purchases and credit cash

- D. purchases and credit shares

Bala Ltd acquired the business of Bello Ltd and caused the separate existence of the latter company to terminate. This situation is best described as?

- A. absorption

- B. merger

- C. conversion

- D. dissolution

On the dissolution of a partnership business,the net book value of the assets is transferred to?

- A. debit of realization account

- B. credit of realization account

- C. credit of bank account

- D. debit of bank account

If a partner pays a premium of N500 for 1/5 share of profit, then the total value of goodwill is?

- A. N500

- B. N2,000

- C. N2,500

- D. N3,000

Marhumu and Yusuf are in partnership sharing profits and losses in the ratio of 2:1. On 31/3/2000, the partnership decided to admit Idris who is to take 1/4 of future profits without changing the ratio of Marhumu and Yusuf.

What is the new profit-sharing ratio of Marhumu and Yusuf?

- A. 50% : 25%

- B. 50% : 20%

- C. 25% : 50%

- D. 25% :25%

Partners’ salaries and drawings are usually posted to the?

- A. trading account

- B. current account

- C. capital account

- D. partners' account