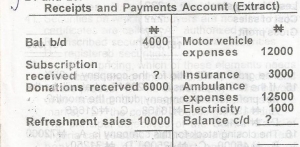

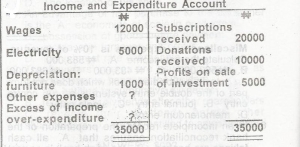

Subscriptions received are always put at 125% of the total donations received and refreshment sales.

Compute the subscriptions received.

- A. N30000

- B. N28000

- C. N24000

- D. N20000

Subscriptions received are always put at 125% of the total donations received and refreshment sales.

What is the closing cash balance ?

- A. N11500

- B. N12000

- C. N13000

- D. N13500

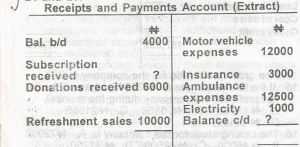

Miscellaneous expense is 10% of revenue Calculate the net income.

- A. N583,000

- B. N563,000

- C. N483,000

- D. N581,000

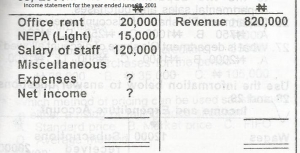

It is the tradition of the club to write off an amount equal to 25% of the subscriptions received as other expenses.

Determine the club’s excess of income over expenditure

- A. N12000

- B. N15000

- C. N10000

- D. N14500

It is the tradition of the club to write off an amount equal to 25% of the subscriptions received as other expenses.

What is the amount to be written off as other expenses?

- A. N4500

- B. N6000

- C. N4000

- D. N5000

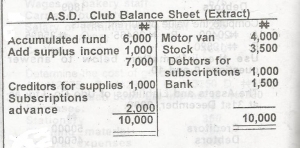

The working capital of the club is

- A. N5000

- B. N4000

- C. N3000

- D. N7000

Use the information below to answer this question.

………….Total……… Dept.P………….Dept.Q

……………N……………N……………..N

Sales………10000…………6000…………..4000

Purchases……4000…………1000…………..3000

Discount received.1000……….?………………

Discounts allowed..2000………………………?.

Discount (allowed and received) are apportioned to the two departments on the basis of departmental sales and purchases.

What is department Q’s share of discount allowed?

- A. N2000

- B. N1500

- C. N800

- D. N1200

Use the information below to answer this question.

………….Total……… Dept.P………….Dept.Q

……………N……………N……………..N

Sales………10000…………6000…………..4000

Purchases……4000…………1000…………..3000

Discount received.1000……….?………………

Discounts allowed..2000………………………?.

Discount (allowed and received) are apportioned to the two departments on the basis of departmental sales and purchases.

Department P’s share of discount received is

- A. N750

- B. N1000

- C. N250

- D. N500

The gross profit on manufactured goods is the difference between the cost of goods manufactured and the

- A. market value of goods produced

- B. prime cost of production

- C. indirect cost of production

- D. goods produced.

Use the information below to answer this question

The partnership agreement between Abba, Baba and Kaka contains the following provision:

(i) 5% interest to be paid on capital and no interest to be charged on drawings

(ii) Profits and losses to be shared in the ratio 3:2:1 respectively

(iii) net profit as at 31/12/95 N 2,250.

……………..Abba……Baba…….Kake

Capital……….5000……4000……3000

Current account…250……100…….175

Salary…………300……300…….—

Drawings……….600……500……..250

Current account balance of Kaka at the end of the year will be

- A. N250

- B. N350

- C. N175

- D. N325

Use the information below to answer this question

The partnership agreement between Abba, Baba and Kaka contains the following provision:

(i) 5% interest to be paid on capital and no interest to be charged on drawings

(ii) Profits and losses to be shared in the ratio 3:2:1 respectively

(iii) net profit as at 31/12/95 N 2,250.

……………..Abba……Baba…….Kake

Capital……….5000……4000……3000

Current account…250……100…….175

Salary…………300……300…….—

Drawings……….600……500……..250

Abba’s capital balance at the end of the year will be

- A. N5475

- B. N5725

- C. N4400

- D. N5000

Use the information below to answer this question

Date………….QTY. …..RATE……..TOTAL

……………(Units)…..N………..N

January 2nd…..500……..25……….12500

March 7th…….250……..28……….7000

Issues were made as follows:

Date…………QTY. (uNITS)

January 9th …..200

February 14th …200

March 11th ……200

The value of closing stock as at February 14th by simple average method is

- A. N3900

- B. N2500

- C. N4100

- D. N2700

Use the information below to answer this question

Date………….QTY. …..RATE……..TOTAL

……………(Units)…..N………..N

January 2nd…..500……..25……….12500

March 7th…….250……..28……….7000

Issues were made as follows:

Date…………QTY. (uNITS)

January 9th …..200

February 14th …200

March 11th ……200

The closing stock on March 11th by LIFO valuation is

- A. N4200

- B. N2700

- C. N4500

- D. N3900

In the public sector, the method of accounting that reports revenues and expenditures in the period in which they are received and paid is called?

- A. fund accounting

- B. commitment accounting

- C. cash accounting

- D. accrual accounting

Upon the dissolution of a partnership, the Partnership Act provides that the amount realized should be?

- A. used to pay all taxes due to government

- B. used to start a new partnership business by members who are willing

- C. shared equally by the existing partners

- D. used in paying the debts and liabilities of the firm to persons who are not partners

Given:

Balance at 31st December …………N14,744m

Treasury Bills issued Jan-Dec……..N7124m

Revenue for the year …………….N6387m

Expenditure …………………….N8767m

What is the opening balance on the consolidated revenue fund account?

- A. N10,000m

- B. N12,000m

- C. N90,000m

- D. N11,000m

Given:

Sales ……………………….N195,200

Stock 1st January……………..N34,000

Purchases ……………………N126,000

Sales returns ………………..N1,200

Purchases returns …………….N2,000

If the gross profit is N66,000, what is the value of stock at 31st December?

- A. N30,000

- B. N40,000

- C. 50,000

- D. N20,000

Control accounts help to verify the arithmetic accuracy of the postings from the?

- A. subsidiary books into the trial balance

- B. ledger into the trial balance

- C. journals into the ledgers

- D. subsidiary books into the ledgers

keeping records under the single entry system has the advantage of?

- A. quality in terms of records

- B. completeness in terms of records

- C. accuracy in terms of operation

- D. simplicity in terms of operation

Given an incomplete record without sufficient information to determine profit, the necessary thing to do is to?

- A. draw up the statement of affairs

- B. draw up a T-account to establish the amount

- C. compare the journal entries with the cash book

- D. cross-check the cash book for further information

In an incomplete record system a trading account cannot be prepared until the?

- A. day book has been balanced

- B. amount of personal drawings has been established

- C. cash book has been balanced

- D. amount os sales and purchases has been established