Use the information below to answer questions.

Entrance fees…………………….N1200

Subscriptions(including N850 arrears).N4310

Donations received………………..N1500

Proceeds from sales……………….N2300

Total payments……………………N8200

Depreciation……………………..N2100

Closing cash balance………………N1110

The club deposited 200% of the closing cash balance in he bank during the period.

Determine the opening cash balance of the

- A. N3070

- B. N2220

- C. N5710

- D. N4320

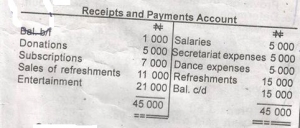

Given:

Calculate the surplus income.

- A. N45 000

- B. N44 000

- C. N30 000

- D. N14 000

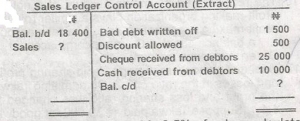

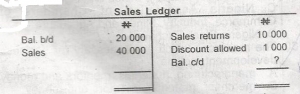

If the discount allowed is 2.5% of sales, calculate the closing balance in the sales ledger account

- A. N 1400

- B. N6 600

- C. N16 600

- D. N18 600

If cheques of N40 000 were received but a cheque of N8 000 was dishonoured, the amount owed was

- A. N9 000

- B. N20 000

- C. N 1000

- D. N17 000

A sole trader purchased goods in cash worth N2000 at 2% discount and made a cash sale of N1000 at the same rate of discount. Determine the amount of discount allowed?

- A. N20

- B. N40

- C. N400

- D. N200

Given:

Bank overdraft…………..N2000

Cash……………………N2000

Furniture……………….N4000

Calculate the total amount on the credit side of the trial balance?

- A. N4000

- B. N2000

- C. N6000

- D. N8000

One of the benefits of book-keeping records is that they?

- A. give prospective investors accurate and direct information for decisions-making

- B. provide the public and creditors with details of the operations of an entity

- C. give legal backing to all the transactions undertaken by a business entity

- D. provide information without which the task of management would be difficult

If Mr. Ajasin paid his creditors N5000 out of N20 000 owed, what would be the effect of this transaction on the accounting equation?

- A. A decraese in the total asssets by N5000

- B. An incraese in the total liabilities and owners' equity by by N15 000

- C. An increase in the total assets by N15 000

- D. A decrease in owners' equuity by N5000

Use the information below to answer questions

Given:

Returns inwards…………N1500

cash…………………..N1550

Discount……………….N2850

Capital………………..N3800

Debtors………………..N900

Sundry…………………N?

The value of sundry expenses is 150% of returns inwards plus 50% of debtors

The total of the trial balance is?

- A. N6600

- B. N6650

- C. N5600

- D. N5900

Use the information below to answer questions

Given:

Returns inwards…………N1500

cash…………………..N1550

Discount……………….N2850

Capital………………..N3800

Debtors………………..N900

Sundry…………………N?

The value of sundry expenses is 150% of returns inwards plus 50% of debtors.

How much is sundry expenses?

- A. N2700

- B. N2250

- C. N1550

- D. N2000

The fourth stage of the accounting information system is?

- A. recording

- B. interpreting

- C. summarizing

- D. classifying

Use the information below to answer questions

Balance as per cash book…………….N13560

Unpresented cheques…………………N5120

Uncredited lodgements……………….N2300

Dividend received not entered

in the cash book……………………N2000

Bank charges……………………….N280

Standing order payments……………..N600

Balance as per bank statement…………?

What is the adjusted cash book balance?

- A. N14 680

- B. N15 560

- C. N16 440

- D. N17 000

Use the information below to answer questions

Balance as per cash book…………….N13560

Unpresented cheques…………………N5120

Uncredited lodgements……………….N2300

Dividend received not entered

in the cash book……………………N2000

Bank charges……………………….N280

Standing order payments……………..N600

Balance as per bank statement…………?

Calculate the balance in the bank statement.

- A. N14 680

- B. N15 560

- C. 17 500

- D. 16 380

Journal proper is used in recording?

- A. transactions that are not regular

- B. returns from customers

- C. credit sales

- D. the receipt and payment for money

The process whereby a cheque received by one person is given to another is known as?

- A. cheque crossing

- B. payment in cheque

- C. cheque transfer

- D. cheque endorsement

Use the information below to answer question

Net loss…………………..N2300

Capital……………………N10500

Liabilities………………..N7200

What will be the equity of the business?

- A. N12 800

- B. N4900

- C. N8200

- D. N9500

Use the information below to answer question

Net loss…………………..N2300

Capital……………………N10500

Liabilities………………..N7200

Find the value of the total assets?

- A. N17 700

- B. N10 500

- C. N20 000

- D. N15 400

Given:

Prepaid b/f…………………..N10 000

Cash paid during the year………N20 000

The amount to be charged to the profit and loss account is?

- A. N30 000

- B. N25 000

- C. N5 000

- D. 20 000

The purchases ledger control account showed a credit balance of N525 000 on April 30, 2006.

This amount shows?

- A. what the debtor of a business enterprise owed the business

- B. the total amount which each debtor owed the business

- C. what a business enterprise owed its creditors

- D. the amount whicih a business enterprise owed creditor

Use the information below to answer question .

Debtors……………………………N20

Provision for bad debts………………10%

Provision for discount on debtors……..5%

The provision for bad debt is?

- A. N2000

- B. N800

- C. N3000

- D. N1900

Use the information below to answer question

Debtors……………………………N20

Provision for bad debts………………10%

Provision for discount on debtors……..5%

Determine the amount provided for discount allowed on debtors?

- A. N1000

- B. N3000

- C. N900

- D. N1500