Use the information to answer the question.

……………………..30/9/06…….30/9/07…..

……………………….N………….N………

Accrued insurance premium…600………..710…….

Prepaid rent income………490…………630……

The cash book includes N1,850 and N,2,100 in respect of insurance premium and rent income respectively.

What amount is to be credited to the profit and loss account in respect of rent income?

- A. N1,710

- B. N1760

- C. N2000

- D. N2240

Use the information to answer the question.

……………………………………………30/9/06…….30/9/07…..

……………………………………………….N………….N………

Accrued insurance premium……..600………..710…….

Prepaid rent income………………..490…………630……

The cash book includes N1,850 and N,2,100 with respect to insurance premium and rent income respectively.

The insurance premium to be taken to the profit and loss account would be.

- A. N1,310

- B. N1,850

- C. N1,990

- D. 2,210

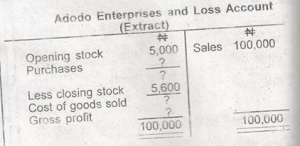

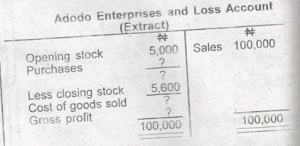

If the opening stock is 5% of sales. calculate the purchases

- A. N95,600

- B. N95,000

- C. N90,600

- D. N85,000

If the gross profit margin is 10% of sales, what is the value of the cost of goods sold?

- A. N10,000

- B. N90,000

- C. N105,600

- D. N110,000

One of the reasons for the existence of the public sector is to?

- A. Take adequate care of the needy

- B. supplement the commercial sector

- C. provide cheap services to all citizens

- D. correct perceived inequalities

Which of the following is credited to the consolidated revenue fund?

- A. Recurrent expenditure

- B. Capital expenditure

- C. Transfer to revenue fund

- D. International revenue

Replacement and renewal of fixed assets are?

- A. revenue receipt

- B. capital receipt

- C. capital expenditure

- D. revenue expenditure

Expenditure incurred on consumables and goods for resale is?

- A. revenue expenditure

- B. capital expenditure

- C. sunk cost

- D. miscellanous expenses

The book value per share is obtained by dividing?

- A. shareholders equity by outstanding shares

- B. total assets by outstanding shares

- C. gross profit by outstanding shares

- D. net profit by outstanding shares

Provision for bad and double debts in companies final accounts is treated in?

- A. trading account

- B. profit and loss account

- C. fund flow statement

- D. cash flow statement

Use the information below to answer questions below;

A company advertised and issued N750,000, 12% preference shares of N1 each to be issued at N1.50 per share. Applications for N1,370,000 were received at 30k per share. 70k per share (including premium) was due on allotment while 25k per share was due on each of the remaining two calls. All amounts due were received . Application money for 120,000 shares was refunded to unsuccessful applicants were allotment shares on pro-rata basis.

The second and final call account was debited with?

- A. ordinary share capital account N187,500

- B. 12% preference share capital N375,000

- C. bank account N187,500

- D. 12% preference share capital account N187,500

Use the information below to answer questions below;

A company advertised and issued N750,000, 12% preference shares of N1 each to be issued at N1.50 per share. Applications for N1,370,000 were received at 30k per share. 70k per share (including premium) was due om allotment while 25k per share was due on each of the remaining two calls. All amounts due were received . Application money for 120,000 shares was refunded to unsuccessful applicants were allotment shares on pro-rata basis.

The share premium account would be?

- A. credited with application and allotment N187, 500

- B. debited with appllication and allotment N375,000

- C. credited with application and allotment N375, 000

- D. debited with application and allotment N187, 500

In a partnership account, conversation of non-cash assets into cash is referred to as?

- A. realization

- B. disposal

- C. dissolution

- D. revaluation

Use the information to answer question below

Capital balances b/d:…..P………….N20,000

……………………..K………….N10,000

Drawings:……………..P………….N2, 000

……………………..K………….N1, 000

Share of profits:………K………….N4, 000

……………………..K………….N2, 000

Salary………………..P………….N1, 000

Interest on drawings:…..K………….N100

……………………..K………….N20

If the capital of the partnership is unfixed, what is K’s current accounts?

- A. N11,950

- B. N10,950

- C. N20

- D. N 0

- E. NO OPTION

Use the information to answer question below

Capital balances b/d:…..P………….N20,000

……………………..K………….N10,000

Drawings:……………..P………….N2, 000

……………………..K………….N1, 000

Share of profits:………K………….N4, 000

……………………..K………….N2, 000

Salary………………..P………….N1, 000

Interest on drawings:…..K………….N100

……………………..K………….N20

Assuming that the partnership maintains a fixed capital, what is P’s closing capital?

- A. N25,000

- B. N24,900

- C. N22,900

- D. N20,000

Given:

Net profit b/d…………………N10,000

Interest on capital:…M………..N2, 000

…………………..K………..N1, 000

Partners’ on salary….K………..N800

Interest on drawings…M………..N500

Profit sharing ratio M and K 3:2

Determine M’s share of profit?

- A. 6,280

- B. 4,020

- C. 2,820

- D. 2,280

Sule and Ahmad are in partnership sharing profits and losses equally. If Khadija is admitted as new partner to take \(\frac{1}{5}\) as her share, what is the new profit or loss sharing ratio?

- A. Sule 1/3, Ahmad 1/3 and Khadija 1/3

- B. Sule 1/5, Ahmad 15 and Khadija 3/5

- C. Sule 2/5, Ahmad 2/5 and Khadija 1/5

- D. Sule 2/5, Ahmad 1/5 and Khadija 2/5

Which of the following is a common cause of a discrepancy between head office and branch trial balance?

- A. Debtors and cash in transit

- B. Creditors and cash in transit

- C. Stock and cash in transit

- D. Stock and prepayments

One of the purposes of maintaining the account of a branch at the head office is to?

- A. record charges in shareholdings

- B. record charges in liabilities

- C. check the excesses of customers

- D. check and monitor the growth of individual branches

Use the information to answer questions

……………………. Departments

……………………… P Q R

Sales value…………… N23,400

Selling expenses………. 1,100 N1,400 N1,280

Administrative expenses…N1,400 N1,000 N1,020

Cost of sales…………. N6,900…. N6,700 N5,500

Sales value of department Q doubles that of p, which is 1/3 of R. Depreciation which amounts to N1,800 is to be apportioned among the three departments in the ratio 3:5:7 respectively.

Determine the total expenses of department P?

- A. 9,760

- B. 9,400

- C. 2,860

- D. 2,500

Use the information to answer question below

……………………. Departments

……………………… P Q R

Sales value…………… N23,400

Selling expenses………. 1,100 N1,400 N1,280

Administrative expenses…N1,400 N1,000 N1,020

Cost of sales…………. N6,900…. N6,700 N5,500

Sales value of department Q doubles that of p, which is 1/3 of R. Depreciation which amounts to N1,800 is to be apportioned among the three departments in the ratio 3:5:7 respectively.

What is the sales value of department R?

- A. N7,800

- B. N11,700

- C. N23,400

- D. N35,100