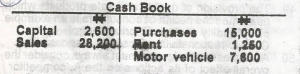

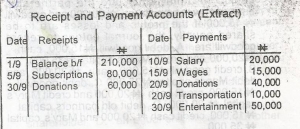

Determine the bank balance

- A. N 6,950 credit

- B. N6,950 debit

- C. N6,000 credit

- D. N6,000 debit

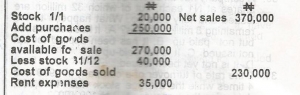

Use the information above to answer the question

Calculate the net profit.

- A. N35,000

- B. N40,000

- C. N105,000

- D. N115,000

Use the information above to answer the question

Find the gross profit.

- A. N370,000

- B. N230,000

- C. N150,000

- D. N140,000

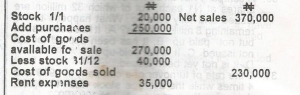

The 5% discount shown above indicates

- A. trade discount

- B. cash discount

- C. discount allowed

- D. discount received

Given:

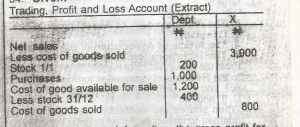

From the above information, the gross profit from department X is

- A. N3,800

- B. N2,300

- C. N2,200

- D. N2,000

Given:

Determine the balance

- A. 415,000 debit

- B. 215,000 credit

- C. 215,000 debit

- D. 315,000

The power to appoint the Auditor General of the Federation is vested in the

- A. National Assembly

- B. President

- C. Judicial Service Commission

- D. Civil Service Commission

The Petroleum Technology Development Fund is under the

- A. general fund

- B. contingency fund

- C. trust fund

- D. capital fund

The book into which all types of a ministry’s expenditure are recorded is the

- A. ledger book

- B. payment book

- C. vote book

- D. expenditure book

Which of the following is a source of revenue to the federation account?

- A. Market fees

- B. Bicycle licences

- C. Tarrifs

- D. Property rates

Purchasers – #44,880

Sales – #85,850

Trade creditors – #12,250

Trade debtors – #24,000

Accrued expenses – # 350

Prepaid expenses – # 700

Stock 1/1/2006 – #25,120

Stock 31/12/2006 – #27,840

Determine the number of times stock was turned over during the period to the nearest figure

- A. 1

- B. 2

- C. 3

- D. 4

Purchasers – #44,880

Sales – #85,850

Trade creditors – #12,250

Trade debtors – #24,000

Accrued expenses – # 350

Prepaid expenses – # 700

Stock 1/1/2006 – #25,120

Stock 31/12/2006 – #27,840

Calculate the acid test ratio

- A. 1:94:1

- B. 1:96:1

- C. 1:1:94

- D. 1:1:96

Investment at cost of a company is to be disclosed under

- A. trading accounts

- B. profit and loss account

- C. balance sheet

- D. source and application of fund

When shares are oversubscribed and money returned to unsuccessful applicants, the entry to record such money is to debit

- A. application and allotment account and credit unsubscribed shares

- B. application and allotment account and credit cash

- C. oversubscribed shares and credit allotment account

- D. oversubscribed shares and credit allotment account

Given:

1. The Memorandum of Association of the Company

11.The Article of Association of the Company

111. The Incorporation documents

From the above, which of the following is delivered to the Registrar of companies for incorporation

- A. 1 and 11

- B. 1, 11 and 111

- C. 1 and 111

- D. 11 and 111

In converting a partnership into a limited liability company, the necessary accounts to be opened in the books of the company are

- A. business purchase account and ordinary share capital account

- B. Business purchase account, vendor account and ordinary share capital account

- C. business purchase account and vendor account

- D. ordinary share capital account, vendor account and unpaid share capital account

Ngozi and Musa with a capital of #30,000 each decide to admit Mary into the partnership business with a capital of #20,000 and goodwill #15,000.If the profits and losses are to be shared equally, the journal entries to record goodwill are

- A. debit goodwill #15,000, cash #20,000 and credit Mary's capital #35,000

- B. credit goodwill #15,000, cash #20,000 and debit Mary's #35,000

- C. debit goodwill #15,000, credit cash #20,000 and credit Mary's capital #20,000

- D. debit old partners capital #15,000, credit cash #20,000 and Mary's capital #35,000

In what way can goodwill be written off in a partnership business?

- A. Using the partners' profit and loss sharing ratio

- B. By neglecting the ratio of partners capital contributions

- C. By sharing it unequally among the partners where no agreement exists

- D. By sharing it among the active partners only

The partners capital are: Modibbo #60,000

and Jakata #90,000. The partners share

profit and losses in the ratio of their capital

contributions.

The net profit for the year is #12,000.

What is Jakata’s sharing profit?

- A. 3:5

- B. 1:2

- C. 2:5

- D. 1:5

The partners capital are: Modibbo #60,000

and Jakata #90,000. The partners share

profit and losses in the ratio of their capital

contributions.

The net profit for the year is #12,000.

Find Modibbo’s share of the profit

- A. #62,000

- B. #48,000

- C. #44,000

- D. #43,000

Which of the following methods of invoicing goods to branches facilitate easy checks on the activities of branches?

- A. cost price

- B. fixed percentage on cost

- C. selling price

- D. invoice price