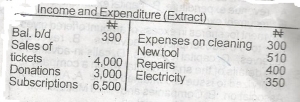

What is the balance carried down?

- A. N11,680

- B. N11,930

- C. N12,330

- D. N13,430

What is the total income for the period?

- A. N13,890

- B. N13,500

- C. N10,500

- D. N9,500

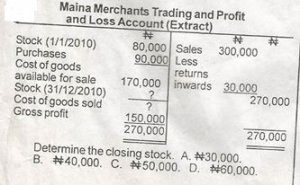

Determine the closing stock.

- A. N30,000

- B. N40,000

- C. N50,000

- D. N60,000

The formula for calculating depreciation using straight line method is

- A. \( \frac{\text{Scrape Value} + \text{Sales}}{Useful life} \)

- B. \( \frac{\text{Cost } - \text{Scrape Value}}{Useful life} \)

- C. \( \frac{\text{Sales } - \text{Scrape Value}}{Useful life} \)

- D. \( \frac{\text{Purchases } + \text{Sales }}{Useful life} \)

In government accounting, the method used which records on the basis of financial entity with self-balancing books instead of entity of proprietorship is

- A. virement

- B. fund accounting

- C. consolidated fund

- D. financial regulation

The account of government into which all monies are received and from which all expenditures are disbursed is the

- A. Federation account

- B. Petroleum Technology Development Fund

- C. Central Bank Account

- D. Development fund

Oil and Buns issued to the public 1,300,000 ordinary shares of 75k at a price of #1.50k. Application and allotment were received for 900,000 shares at 25k each.

The book value of issued share capital is

- A. #675,000

- B. #975,000

- C. #1,350,000

- D. #1,950,000

Oil and Buns issued to the public 1,300,000 ordinary shares of 75k at a price of #1.50k. Application and allotment were received for 900,000 shares at 25k each.

Determine the amount received on application and allotment

- A. #224,950

- B. #225,000

- C. #324,950

- D. #325,000

#800,000 worth of ordinary shares of 50k were issued at #1 each, payable in full on application. The entry in the cash book would be to

- A. credit #1,600,000

- B. debit #1,600,000

- C. credit #1,600,000

- D. debit #800,000

The details of the share capital which a company is authorized to issue is contained in the

- A. Articles of Association

- B. Companies and Allied Matters Act

- C. Memorandum of Association

- D. Share capitak certificate

Payment for shares in excess of amount offered gives rise to

- A. subscription in advance

- B. revenue reserves

- C. capital reserves

- D. calls-in-advance

The expenses incurred in purchasing a vehicle is a

- A. revenue expenditure

- B. capital expenditure

- C. recurrent expenditure

- D. concurrent expenditure

Where partnership is converted into a limited liability company, current account balances of partners are transferred to a

- A. realization account

- B. savings account

- C. share capital account

- D. capital account

The profit of a branch is usually credited to the

- A. adjustment account

- B. head office sales

- C. head office goods account

- D. head office current account

In the absence of a partnership deed, the act stipulates that

- A. an amount should be fixed as salary for partners

- B. interest on partners loan should be 25%

- C. interest should not be allowed on partners drawings

- D. profits and losses should not be shared equally

Hussaina Enterprises sent goods worth #800,000 at cost plus mark-up of 20% to its branch

Determine the profit on the goods sent to the branch at profit margin of 25% mark-up

- A. #150,000

- B. #160,000

- C. #170,000

- D. #180,000

Hussaina Enterprises sent goods worth #800,000 at cost plus mark-up of 20% to its branch

What is the cost price of the goods sent to the branch

- A. #600,000

- B. #620,000

- C. #640,000

- D. #700,000

If goods are sent to to branch at 25% on cost, what will be the cost of goods sent to the branch at a selling price of #100,000?

- A. #130,000

- B. #125,000

- C. #80,000

- D. #75,000

In a departmental account, the expenses to be apportioned on the basis of turnover is

- A. carriage inwards

- B. returns outwards

- C. discount recieved

- D. carriage outwards

In a departmental account, where no basis of apportionment exist, apportionment is

- A. on profit basis

- B. according to employee decision

- C. according to material available

- D. on equal basis

Given:

Sales #180,000

Stock 1/1 # 25,000

Purchases #110,000

Sales returns # 1000

Purchases returns # 1,500

Gross profit # 58,000

Determine the value of stock as at 31st December

- A. #8000

- B. #9,500

- C. #12,500

- D. #15,500