Aliyu bought 100 shares at the stock market through a stockbroker. He was told the price each share was N3 cum. div. This means that Aliyu

- A. is entitled always to a cumulative dividends accruing from the shares

- B. is entitled to the next dividends due to the shares

- C. will not be entitled to the next dividends due to the shares

- D. still owes N3 on the shares which will be subtracted from the dividends

The elimination of fault in a computer programme is called?

- A. console

- B. debug

- C. dump

- D. loop

(i)Foreign investment (ii) Long-term lending (iii) Short-term lending (iv)Foreign exchange (v) Short-term borrowing. Which combination of the above include capital account in international trade?

- A. i, iii, and iv

- B. ii, iii and iv

- C. ii and v

- D. i and ii

The three major function unit which the modern computer has are

- A. the input the processor and the output units

- B. the black box, output and input units

- C. BASIC, COBOL and output uits

- D. BASIC, the processor and PASCAL

Tolu purchase goods from Yemisi and is to pay custom duties before collection. The goods are likely to be collected from.

- A. a manufacturer's warehouse

- B. a bonded warehouse

- C. an importer's warehouse

- D. a wholesaler's warehouse

The principle of subrogation states that

- A. an insured person should be indemnifed to the tune of the amount insured

- B. an insurance company can stand in place of the insured in dealing with third party

- C. oly a person who is likely to sufferrd loss should take take out an insurance cover

- D. ther must be a close connection between the actual loss suffered and risk insured

The rate at which a central bank discount first class bills is called the

- A. fixed rate

- B. bill rate

- C. bank rate

- D. interest rate

A distinction between Comprehensive insurance and Thrid party Insurance is that the latter covers damages

- A. caused by the insured vehicle

- B. to the insured vehicle

- C. cause by the other vehicle

- D. to the driver of insured vehicle

The overriding advantage of home trade over foreign trade is

- A. accessibility of seller to buyer

- B. absence of many documents

- C. ease in language of transaction

- D. ease in form of payment

Which of the following document permit an importer to inspect his goods before the arrival of the bill of lading?

- A. Bill of sight

- B. Import invoice

- C. Consular invoice

- D. Bill of exchange

The document that indicate instant payment of cash for goods whenever the are delivered is

- A. credit note

- B. proforma invoice

- C. debit note

- D. statement of account

The main document sent to an importer of goods by the exporter are?

- A. invoice, consular invoice, certificate of orign, fright note, indent and insurance policy

- B. indent, bill of lading, certificate of orign, invoice and bill of exchange

- C. certificate of orign, bill of exchange, insurance policy, indent and bill of lading

- D. bill of lading, invoice insurance policy, consular invoice, certificate of orign and bill of exchange

Kamaldeen is a seller in a hire-purchase agreement with Emeka. By law, Kamaldeen cannot recover the hire purchased goods. This is an instance of a restriction on

- A. Emeka's right to terminate the agreement

- B. Kamaldeen's right to re-hire the Goods

- C. Emeka's right to breach the agreement

- D. Kamaldeen's right to terminate the agreement

A company which issues a promissory note in lieu of payment for goods purchased

- A. can refuse to pay ondue date since it is only a promise

- B. is bound to redeem the note for cash on due date

- C. is not bound to renew the note before payment

- D. can return the goods purchase and refuse to pay

Kabir receives two quotations. Ade quotes N 100 less 20% trade discount and 20% cash discount while Benson N100 less 30%trade discount and 10% cash discount. If Kabir wants to take advantage and cash discount, then

- A. the material should be supplied by Ade

- B. the material should be supplied by both of them

- C. the material should be supplied by Benson

- D. Benson should be ask to reduce his trade discount

The term ‘5 Net 7’ on an invoice means that?

- A. 5% discount will be allowed on the price charged if payment is made within seven days

- B. 5% discount will be allowed on the price charged if payment is made after seven days

- C. 5% surcharge will be made unless payment is made within seven days

- D. 5% dicount will be allowed on the charged if the goods are bought within seven days

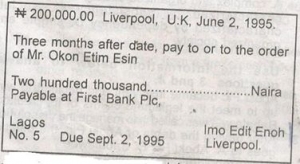

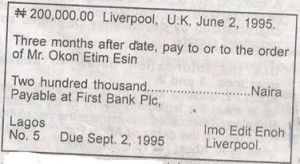

The document represents a

- A. Bill of exchange

- B. Cheque

- C. Money order

- D. A. Promissory note

Use the document below to answer question

Okon Etim Esin is the?

- A. debtor

- B. creditor

- C. exporter

- D. importer

Which of the following is not a veritable source of funds to a public limited company?

- A. government financial grant

- B. advances and loan from banks

- C. internally generated funds

- D. funds from the sale of shares

A business whose owners enjoys loan facilities on the basis of personal goodwill is a?

- A. commercial bank

- B. thrift society

- C. co-operative society

- D. community bank

An abridged version of a company’s income statement for 11993 contains the following information:

N

Turnover 286.5

cost of goods sold 147.5

overhead and other expenses 85.5

Taxes due for the year 26.9

What was the company’s profit before tax for 1993?

- A. 26.9 million

- B. 53.5 million

- C. 139.2 million

- D. 286.5 million