The part of income after tax that is not consumed is defined as

- A. Wages and salaries

- B. Saving

- C. Capital investment

- D. Nondurable goods expenditure

The “velocity” of money is

- A. The real money supply divided by the real GDP

- B. The money supply multiplied by the price level

- C. The money supply divided by the price level

- D. The ratio of real GDP to the real money supply

The short run can be defined as the period of time during which

- A. All inputs are fixed

- B. At least one of the firm's input is fixed

- C. At least two inputs are fixed

- D. All inputs are variable

The marginal propensity to consume is

- A. Options A, B and C

- B. ΔC/ΔY

- C. The slope of the consumption function

- D. Coefficient c in the equation C = C + cYd

Which of the following is an example of free good?

- A. Free education

- B. Water in the ocean

- C. Dinner you did not pay for

- D. Your rented apartment

The demand for a good is price inelastic if

- A. The price elasticity is less than one

- B. The price elasticity is one

- C. The price elasticity is negative

- D. The price elasticity is greater than one

A tariff is a tax imposed on

- A. Consumer goods

- B. Domestic goods

- C. Imported goods

- D. Exported goods

(a) What is economic integration?

(b) Outline any three short-comings of the Economic Community of West African States (ECOWAS)

(c) Highlight any three achievements of the Economic Community of West African State (ECOWAS)

(a) Distinguish between a:

→mortgage bank and a merchant bank

→commercial bank and a development bank

(b) Explain any four functions of commercial banks

(a) Explain the following types of taxes:

→specific tax

→value-added tax

(bi) With the aid of diagrams, describe the effects of an indirect tax on a commodity when demand is:

perfectly inelastic

(ii) With the aid of diagrams, describe the effects of an indirect tax on a commodity when demand is:

perfectly elastic

(a) What is a demand schedule?

(b)Explain each of the following terms:

→effective demand

→composite demand

→derived demand

(ci) Using appropriate diagrams, explain how a change in the price of a commodity would influence the demand of its:

substitute

(ii) Using appropriate diagrams, explain how a change in the price of a commodity would influence the demand of its:

complement

(a) Distinguish between labour force and efficiency of labour

(b) Describe five factors which determine the size of the labour force in a country

(a) Define the term limited liability

(b) Describe four differences between a public joint-stock company and a private joint-stock company

(c) Outline three sources of finance available to sole proprietorship

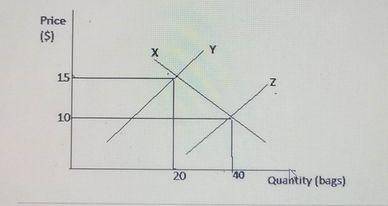

(ai) The diagram above shows the effects of the introduction of a subsidy on the production of maize. Study the diagram and answer the questions that follow.

Identify the curves labelled X,Y,Z

(aii) The diagram below shows the effects of the introduction of a subsidy on the production of maize. Study the diagram and answer the questions that follow.

State the direction of change in price and quantity with the introduction of subsidy

(bi) The diagram below shows the effects of the introduction of a subsidy on the production of maize. Study the diagram and answer the questions that follow.

Calculate the total revenue of the producers before the introduction of subsidy

(bii) The diagram below shows the effects of the introduction of a subsidy on the production of maize. Study the diagram and answer the questions that follow.

Calculate the total revenue of the producers after the introduction of subsidy

(c) The diagram below shows the effects of the introduction of a subsidy on the production of maize. Study the diagram and answer the questions that follow.

Calculate the percentage increase or decrease in total revenue of the producers with the introduction of subsidy

(d) The diagram below shows the effects of the introduction of a subsidy on the production of maize. Study the diagram and answer the questions that follow.

If the quantity demanded of maize increases from 20 to 40 bags as a result of a fall in price from $15 to $10, calculate the price elasticity of demand.

(e) The diagram below shows the effects of the introduction of a subsidy on the production of maize. Study the diagram and answer the questions that follow.

State the type of elasticity of demand in 2(d).

(a) A hypothetical national income data for a country in particular year is presented below:

| ITEM | $MILLION |

| Wages and salaries | 250 |

| Income paid abroad | 75 |

| Income from self-employment | 120 |

| Stock appreciation | 5 |

| Interest | 10 |

| Income received from abroad | 50 |

| Rent | 25 |

| Depreciation allowance | 3 |

| Royalties | 2 |

| Profits and dividends | 35 |

From the data, answer the following questions.

Calculate the: Gross Domestic Product (GDP)

(b) A hypothetical national income data for a country in particular year is presented below:

| ITEM | $MILLION |

| Wages and salaries | 250 |

| Income paid abroad | 75 |

| Income from self-employment | 120 |

| Stock appreciation | 5 |

| Interest | 10 |

| Income received from abroad | 50 |

| Rent | 25 |

| Depreciation allowance | 3 |

| Royalties | 2 |

| Profits and dividends | 35 |

From the data, answer the following questions.

Calculate the: Gross National Product (GNP)

(c) A hypothetical national income data for a country in particular year is presented below:

| ITEM | $MILLION |

| Wages and salaries | 250 |

| Income paid abroad | 75 |

| Income from self employment | 120 |

| Stock appreciation | 5 |

| Interest | 10 |

| Income received from abroad | 50 |

| Rent | 25 |

| Depreciation allowance | 3 |

| Royalties | 2 |

| Profits and dividends | 35 |

From the data, answer the following questions.

Calculate the: Net National Product (NNP)

An increase in the price of commodity X led to a fall in the supply of commodity Y. Commodities X and Y are

- A. competitive goods

- B. composite goods

- C. jointly supplied

- D. derived goods

The supply curve of a locally-produced good may shift to the right if

- A. there is an increase in taxes on inputs

- B. government increases subsidies

- C. rural-urban migration is encouraged

- D. the price of the commodity increases

The demand curve for goods of ostentation is usually

- A. negatively sloped

- B. positively sloped

- C. vertical

- D. horizontal

The increase in the demand for a commodity may lead to a decrease in the demand for another if both are

- A. in complementary demand

- B. of the same quality

- C. in composite demand

- D. in competitive demand

The mining sector of an economy contributes 60% to the Gross Domestic Product(GDP). If the GDP is $540, what is the contribution of the mining sector?

- A. $ 90.00

- B. $ 180.00

- C. $ 324.00

- D. $ 350.00

A major disadvantage of a capitalist economy is that it

- A. leads to low production of goods and services

- B. requires large number of officials to operate

- C. considers individual consumers' satisfaction

- D. worsens income inequality among the citizens