(a) What is protective tariff?

(b) Outline any four reasons in favour of protective tariff.

(c) State any two reasons against protective tariff.

(a) What is deflation?

(b) Outline any three positive effects of deflation.

(c) Explain the ways by which inflation affects any three functions of money.

(a) What is balance of payment disequilibrium?

(b) Explain the two types of balance of payment disequilibrium.

(c) Highlight any four reasons most West African countries are experiencing balance of payment problem.

(a) What are infant industries?

(b) State any four reasons for protecting infant industries.

(c) Outline any three ways by which industries can be financed in West Africa.

(a) Outline any four objectives of a price control policy.

(b) Highlight any four effects of a maximum price control policy.

(a) What is a trade union?

(b) Describe any four functions of trade unions.

(c) Outline any two weapons used by trade unions to achieve their objectives.

The table below shows the incomes and rates of income tax levied on four professionals in an economy.

| Profession | Income per month($) | Tax rate % | Disposable income ($) |

| Doctor | 8,000 | 10 | |

| Engineer | 7,000 | 12 | |

| Civil servant | 5,000 | 18 | |

| Nurse | 6,000 | 15 |

Use the above data to answer the questions that follows:

(a) Calculate the disposable incomes of the four individuals

(b) What system of taxtation was employed?

(c) Give reasons for your answer in 2(b)

(d) With the aid of a diagram, explain the system of taxation employed in 2(b)

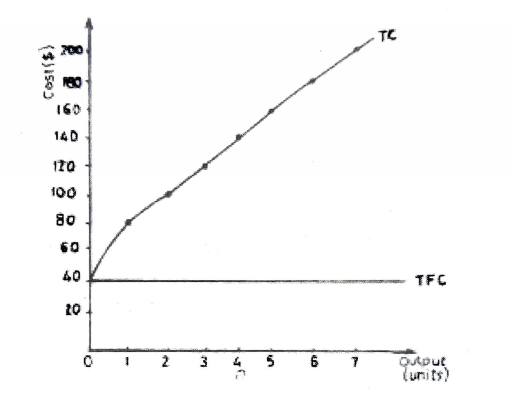

The total fixed cost (TFC) and total cost (TC) functions of a hypothetical firm are shown in the graph below. Study it and answer the questions that follow:

(a) Determine the firm’s

(i) variable cost at output levels 2, 4 and 6

(ii) average total cost at output levels 2 and 3

(iii) marginal cost at output levels 4 and 6

(b) If the price of the firm’s product is $40, calculate the firm’s profit or loss when the following units are sold:

(i) 2 units; (ii) 4 units

| Items | Amount ($m) |

| Rents and royalties | 75.00 |

| Company income tax | 150.00 |

| Custom and excise duties | 300.20 |

| personal income tax | 80.00 |

| Fees and fines | 60.00 |

| value added tax | 100.00 |

Use the information to answer the following question

what is the total revenue from non tax sources

- A. $400.20 m

- B. $375.20 m

- C. $135.00 m

- D. $75.00 m

| Items | Amount ($m) |

| Rents and royalties | 75.00 |

| Company income tax | 150.00 |

| Custom and excise duties | 300.20 |

| personal income tax | 80.00 |

| Fees and fines | 60.00 |

| value added tax | 100.00 |

Use the information to answer the following question

what is the total revenue from indirect tax

- A. $686.0 m

- B. $400.20 m

- C. $135.80 m

- D. $100.00 m

which of the following is a benefit to a member country of World Bank?

- A. easy access to long term loans

- B. management of foreign exchange

- C. mediating in labour dispute

- D. financing balance of payment deficit

In order to correct adverse balance of payments problem, government should?

- A. reduce tariffs

- B. increase subsidies on exports

- C. increase tax on local industries

- D. reduce personal income tax

The abolition of all forms of trade barriers among member countries while maintaining common external tariffs against non members is a feature of a

- A. free trade

- B. custom union

- C. common market

- D. economic union

A country has favourable terms of trade when the prices of her

- A. exports rises relative to the price of her imports

- B. exports falls relative to the price of her imports

- C. imports rise faster than the prices of imports

- D. imports and exports move in the same direction

A concious effort of government to achieve a specific set of goals is?

- A. economic planning

- B. economic development

- C. economic growth

- D. economic target

The export of west A frican countries are mostly composed of

- A. service

- B. raw materials

- C. manufactured goods

- D. consumer goods

when the demand for foreign exchange exceeds its supply, the value of the domestic currency

- A. appreciates

- B. depreciates

- C. remains inchanged

- D. expands

In order to control inflation, the government should

- A. reduce the cost of borrowing

- B. buy securities in the open market

- C. adopt restrictive monetary policy

- D. discourage savings

which of the following is not an objective of economic planning

- A. need to direct economic development of the country towards the desired direction

- B. desire to ensure a sustained cultural development of the country

- C. desire to widen the gap between developing countries and the developed world

- D. management of scarce resources in the face of unlimited wants of the citizens

The proportion of commercial banks’ total assets kept in the form of highly liquid assets is known as

- A. demand deposit

- B. fixed deposit

- C. cash ratio

- D. moral suasion

The main item traded on a stock exchange market is

- A. treasury bills

- B. travellers cheque

- C. foreign currencies

- D. new shares