The table shows the monthly contributions and expenditure pattern of an employee in 1999.

| Item | Percentage |

| Pension | 5 |

| Income Tax | 25 |

| Food | 40 |

| Transport | 10 |

| Rent | 12.5 |

| Others | 7.5 |

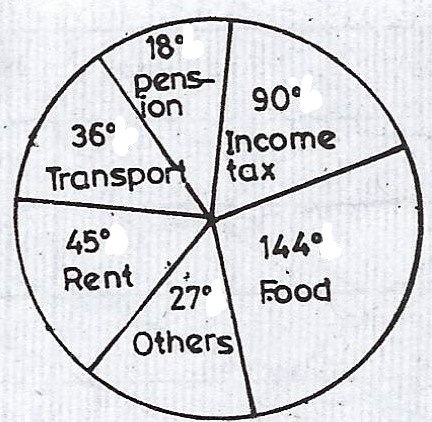

(a) Draw a pie chart to illustrate the data.

(b) If the employee’s gross monthly salary was N10,800.00, calculate (i) the pension contribution of the employee ; (ii) the income tax paid by the employee.

(c) If the pension contribution and income tax were deducted from the gross monthly salary, before payment, calculate the take- home pay of the employee.

Explanation

(a)

| Items | Percentage(%) | Degree in pie chart |

| Pension | 5 | \(\frac{5}{100} \times 360° = 18°\) |

| Income tax | 25 | \(\frac{25}{100} \times 360° = 90°\) |

| Food | 40 | \(\frac{40}{100} \times 360° = 144°\) |

| Transport | 10 | \(\frac{10}{100} \times 360° = 36°\) |

| Rent | 12.5 | \(\frac{12.5}{100} \times 360° = 45°\) |

| Others | 7.5 | \(\frac{7.5}{100} \times 360° = 27°\) |

| 100 | 360° |

A pie- chart showing the monthly contributions and expenditure pattern of an employee in 1999.

(b)(i) \(360° = N10,800.00\)

\(\text{Pension} - 18° = \frac{18}{360} \times N10,800\)

= \(N540\)

(ii) \(360° = N10,800.00\)

\(\text{Income tax} - 90° = \frac{90}{360} \times N10,800\)

= \(N2700\)

(c) The percentage sum of pension and income tax = (5 + 25)% = 30%

Take home pay = 100% - 30% = 70%

= \(\frac{70}{100} \times N10,800\)

= \(N7560\)