ANWSER

Question 1:

What is the primary purpose of cash flow forecasting for contractors?

Answer:

The primary purpose of cash flow forecasting for contractors is to predict cash requirements and avoid insolvency by identifying potential cash deficits in advance. It helps companies plan for temporary financial shortages, negotiate overdraft limits, and make informed decisions about taking on new projects or adjusting existing ones.

—

Question 2:

How do profit flows and cash flows differ, and why is this distinction important?

Answer:

Profit flows represent the net income from operations (revenue minus expenses), while cash flows track the actual movement of money in and out of the company. The distinction is important because credit arrangements, time lags in payments, and other factors can cause profit and cash flow to differ significantly. For example, a company may show a profit but face cash shortages due to delayed client payments or upfront supplier costs.

—

Question 3:

What factors influence cash flow in construction projects?

Answer:

Key factors include:

– Project duration and phasing within the company’s workload.

– Profit margins and retention conditions (e.g., withheld payments).

– Payment delays from clients and credit terms with suppliers/subcontractors.

– Settlement timing of outstanding claims.

– Inflation and interest rates affecting capital lock-up costs.

—

Question 4:

How can companies simplify cash flow forecasting for multiple projects?

Answer:

Companies can:

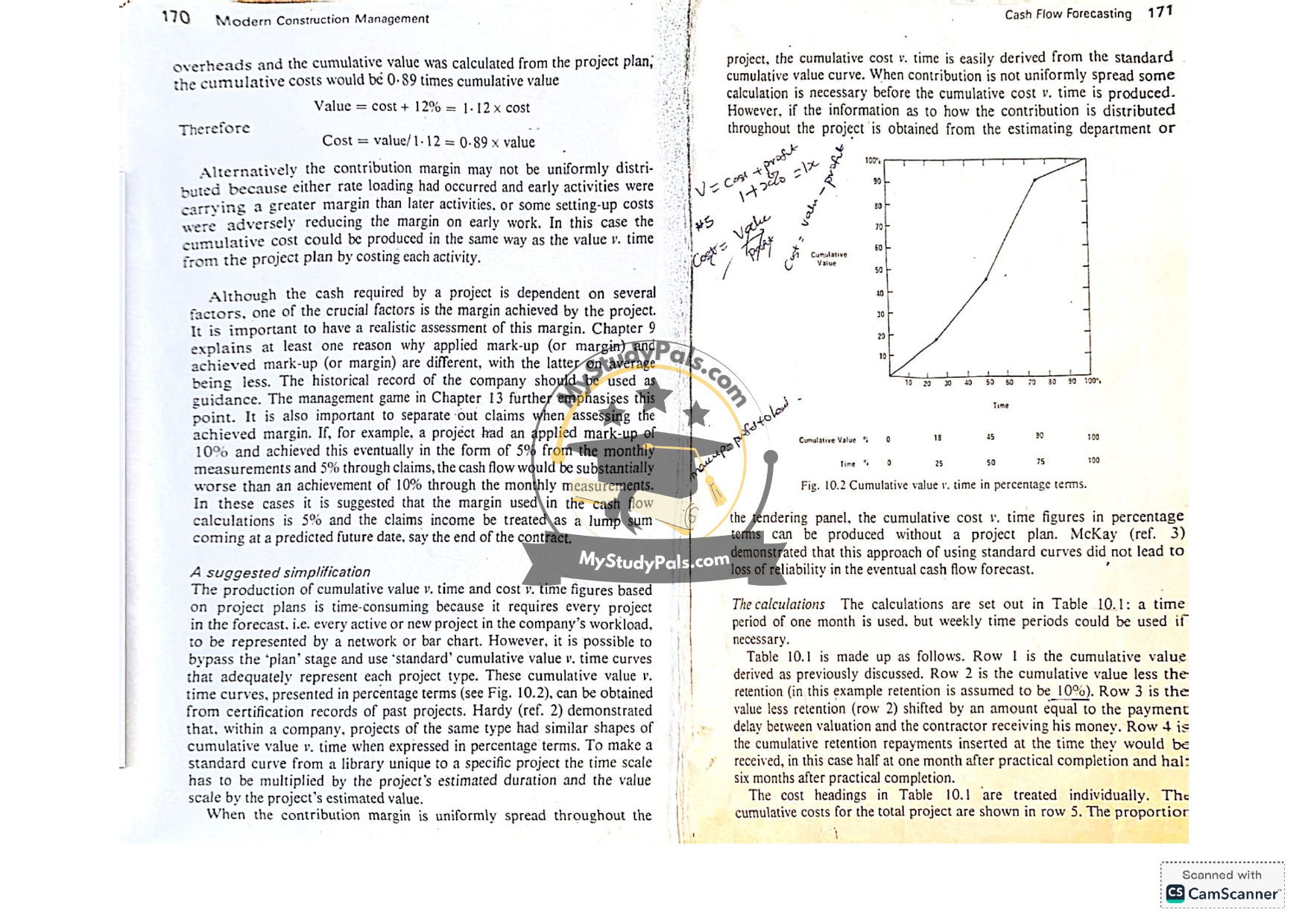

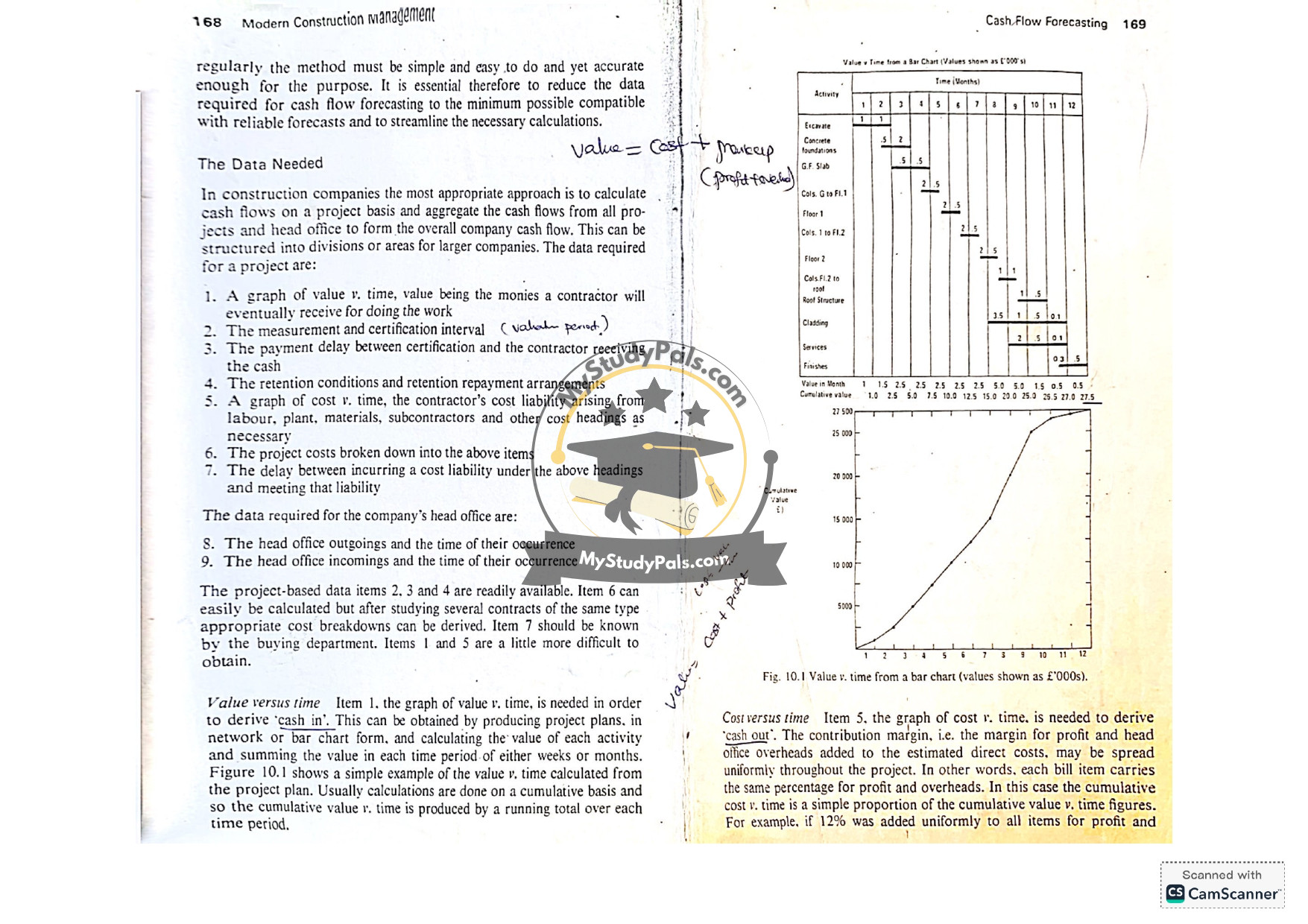

– Use standard cumulative value vs. time curves based on historical project data (expressed as percentages) to bypass detailed planning for each project.

– Focus detailed computerised forecasting on larger contracts (e.g., 60% of workload) and simplify calculations for smaller projects.

– Aggregate cash flows from all projects and combine them with head office inflows/outflows for a consolidated company cash flow.

—

Question 5:

What is “capital lock-up,” and how is its interest cost calculated?

Answer:

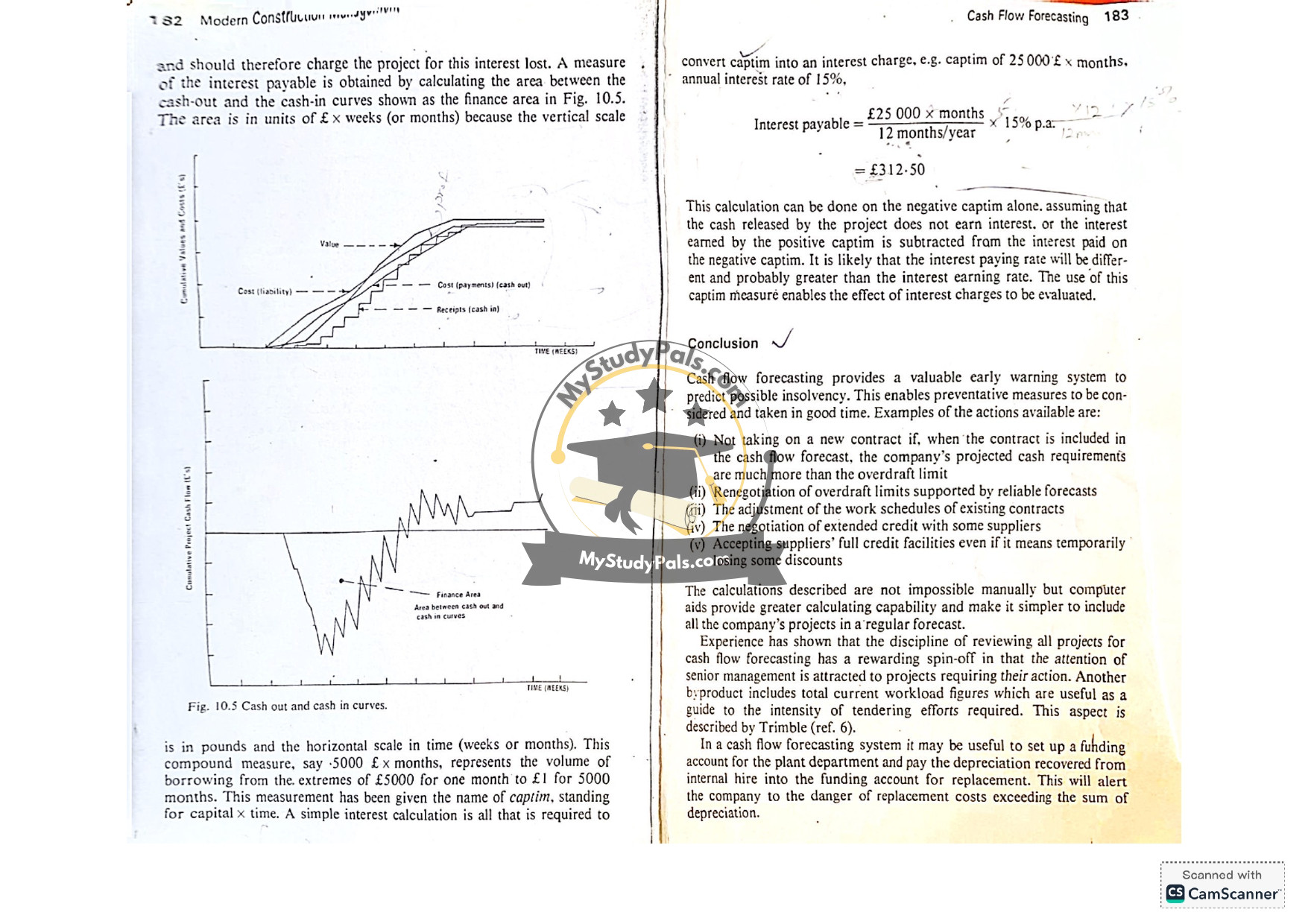

Capital lock-up refers to negative cash flows during early project stages, where funds are tied up in costs before client payments are received. The interest cost is calculated using the “caprim” (capital × time) method:

1. Measure the area between cash-out and cash-in curves (in £ × weeks/months).

2. Multiply the caprim by the annual interest rate (e.g., 25,000 £ × months × 15% / 12 months = £312.50 interest).

—

Question 6:

What actions can a company take if a cash flow forecast predicts insolvency?

Answer:

Possible actions include:

1. Avoiding new contracts that exceed overdraft limits.

2. Renegotiating overdraft terms using reliable forecasts.

3. Adjusting work schedules or payment terms for existing projects.

4. Extending credit with suppliers (even if losing discounts).

5. Utilizing suppliers’ full credit facilities temporarily.

—

Question 7:

Why is computerised cash flow forecasting advantageous?

Answer:

Computers streamline complex calculations, enable regular updates (e.g., quarterly), and allow scenario analysis (e.g., testing new project impacts). They also reduce manual effort, improve accuracy, and facilitate comprehensive forecasts across all projects and head office activities.

—

Question 8:

How does retention affect cash flow, and how is it accounted for in forecasts?

Answer:

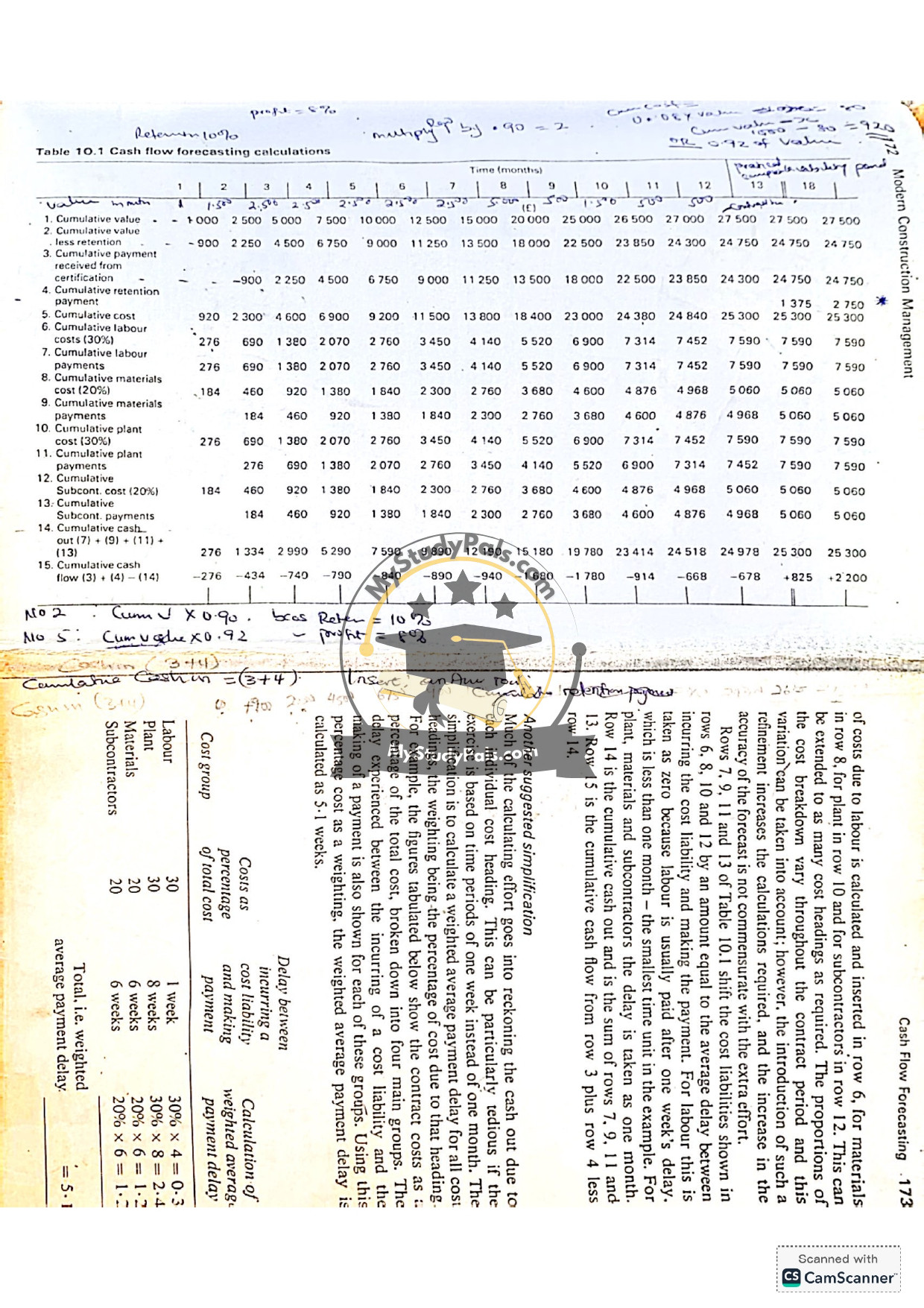

Retention (a portion of payment withheld by clients) delays cash inflows. In forecasts:

– Cumulative value is reduced by the retention percentage (e.g., 10%).

– Retention repayments are added back to cash flow at agreed dates (e.g., half at practical completion, half six months later).

—

Question 9:

What role do historical project records play in cash flow forecasting?

Answer:

Historical data provides standardised curves for value/cost vs. time, helping estimate future project cash flows without detailed planning. Past margins, payment delays, and retention patterns guide realistic assumptions.

—

Question 10:

How can cash flow forecasting improve overall management?

Answer:

Beyond financial planning, it:

– Alerts senior management to projects needing intervention.

– Provides workload insights to guide tendering efforts.

– Highlights replacement costs for assets (e.g., via plant depreciation accounts).

– Encourages proactive financial discipline.

—