ANWSER

—

Question 1:

Why is cash flow forecasting important for contractors in the construction industry?

Answer:

Cash flow forecasting is crucial for contractors because the construction industry experiences a higher proportion of bankruptcies compared to other industries, often due to inadequate cash resources. Forecasting helps contractors anticipate cash shortages, plan for temporary financial difficulties, and convince creditors or lenders of their solvency. It is especially vital during periods of high interest rates or inflation, as highlighted in the Sandilands report, to avoid cash deficits when replacing equipment at inflated costs. Additionally, it prevents confusion between profit flows and cash flows, ensuring accurate financial planning.

—

Question 2:

How do credit arrangements affect cash flows, and why is separate cash flow forecasting necessary?

Answer:

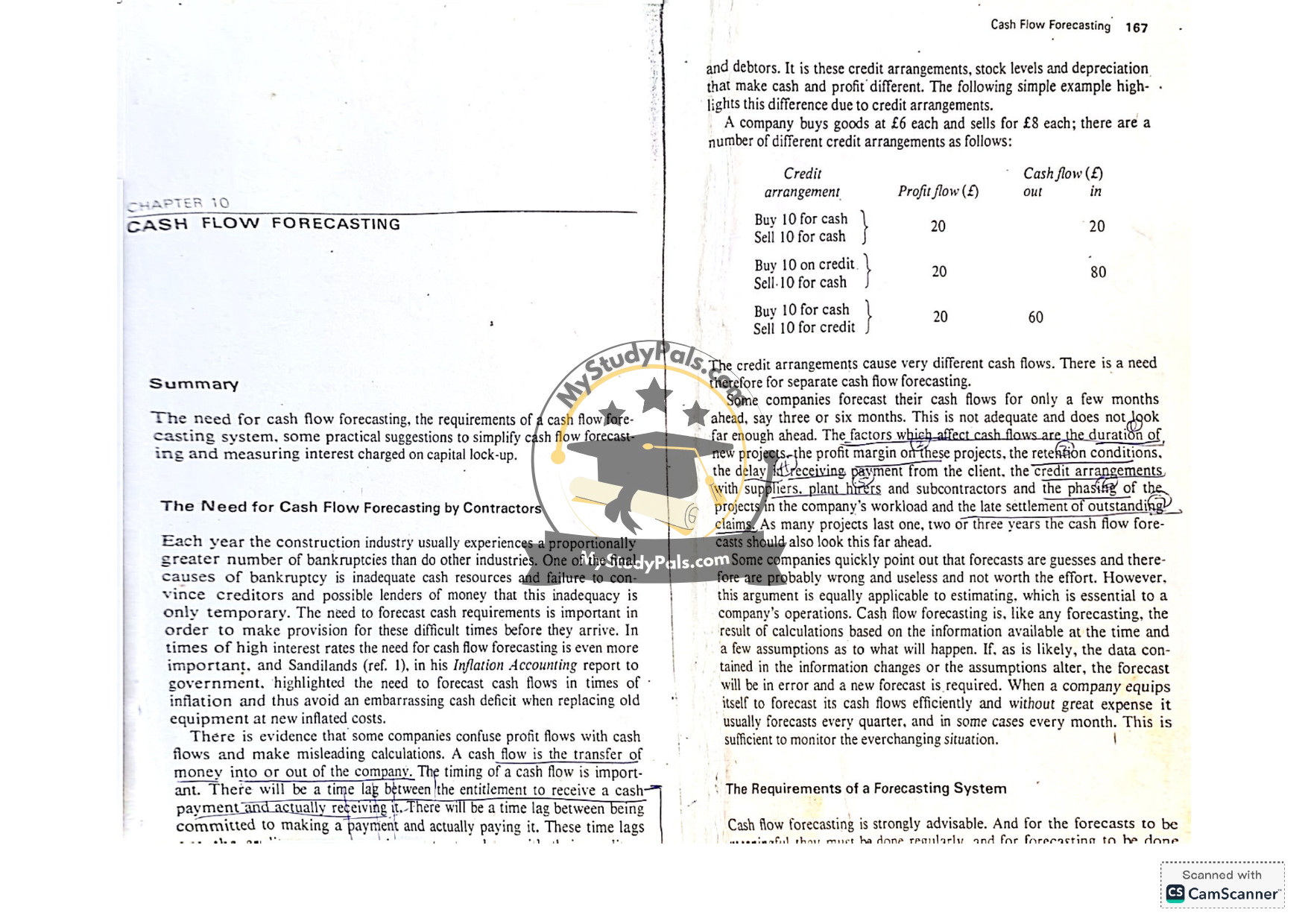

Credit arrangements create time lags between entitlement to payment and actual receipt, as well as between commitment to pay and actual payment. These lags, along with factors like stock levels and depreciation, cause cash flows to differ from profit flows. For example, buying or selling goods on credit alters the timing and amount of cash inflows and outflows, as illustrated in the provided table. Separate cash flow forecasting is necessary to account for these timing differences and ensure accurate financial management.

—

Question 3:

What are the key factors that affect cash flows in construction projects?

Answer:

Key factors include:

– Duration and profit margin of new projects.

– Retention conditions and delays in client payments.

– Credit arrangements with suppliers, subcontractors, and plant hiring.

– Phasing of projects in the company’s workload.

– Late settlement of outstanding claims.

Since projects often last one to three years, cash flow forecasts must cover a similarly long period to be effective.

—

Question 4:

How can companies simplify the process of cash flow forecasting?

Answer:

Companies can simplify cash flow forecasting by:

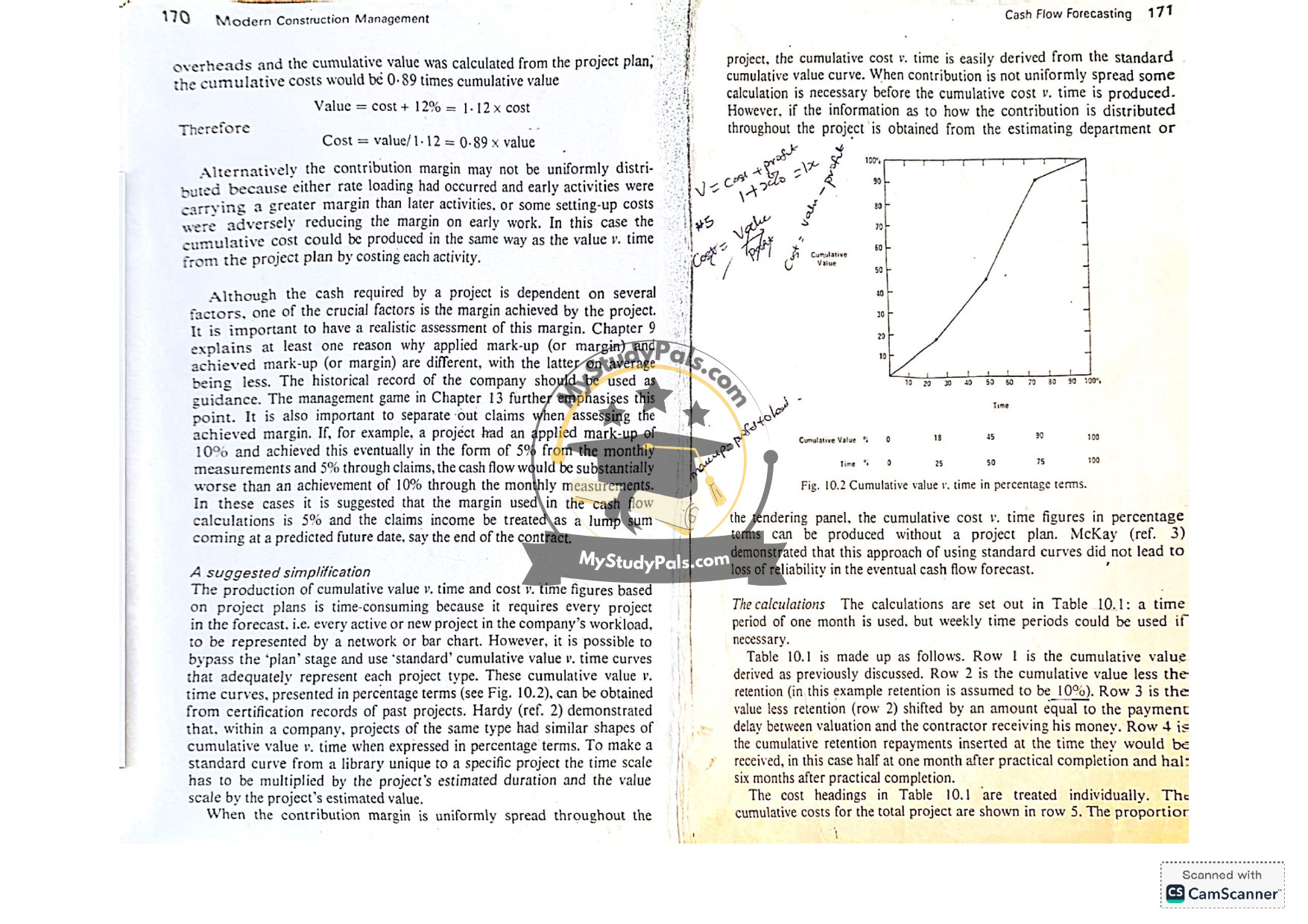

– Using standard cumulative value vs. time curves derived from past projects of the same type, expressed in percentage terms.

– Avoiding detailed project plans for every project by leveraging historical data.

– Separating claims income from regular margins and treating them as lump sums.

– Employing weighted average delays for cost headings to streamline calculations.

This approach reduces effort while maintaining reliability, as demonstrated by Hardy and McKay.

—

Question 5:

Describe the steps involved in calculating cash flows for a construction project.

Answer:

The steps include:

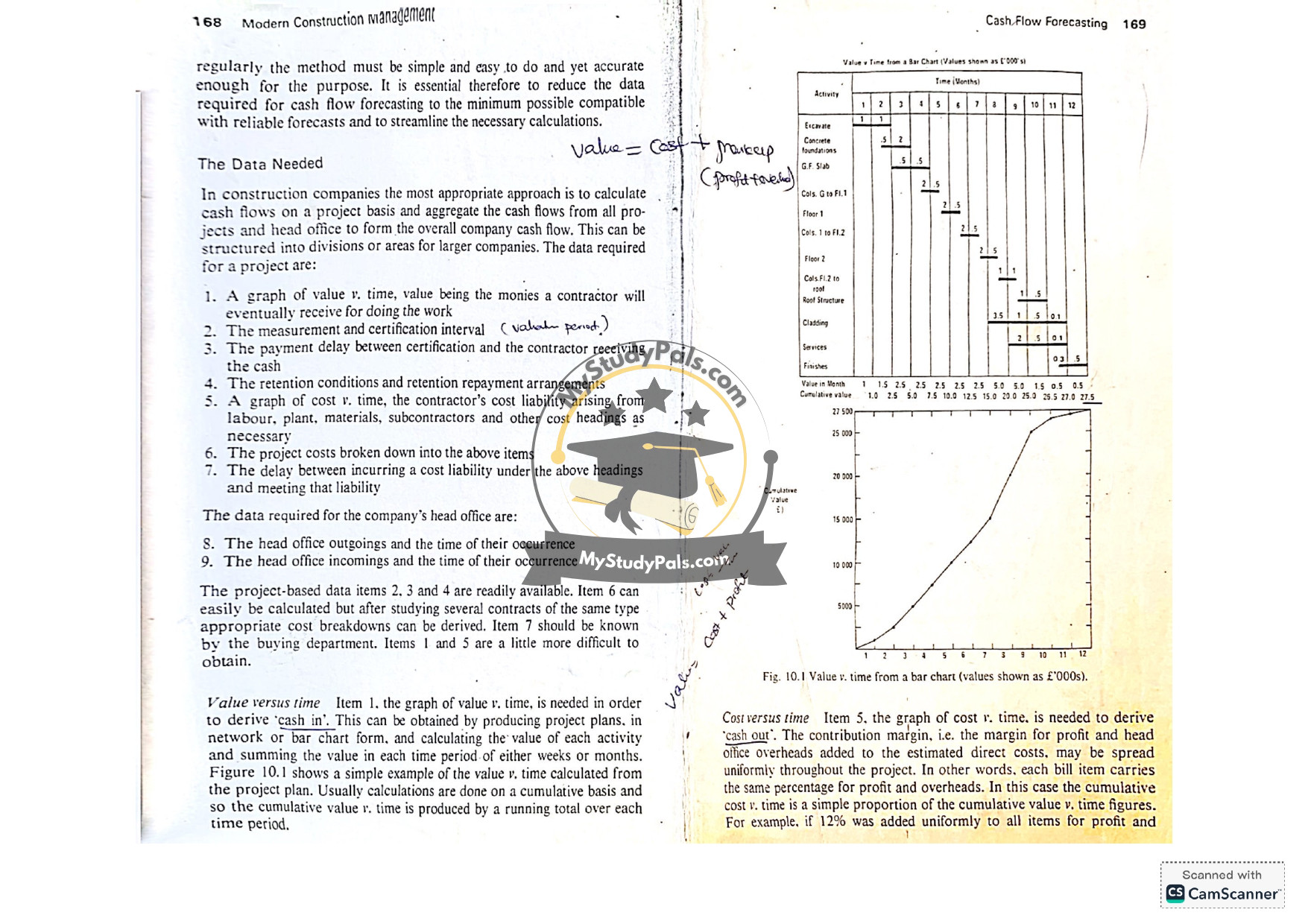

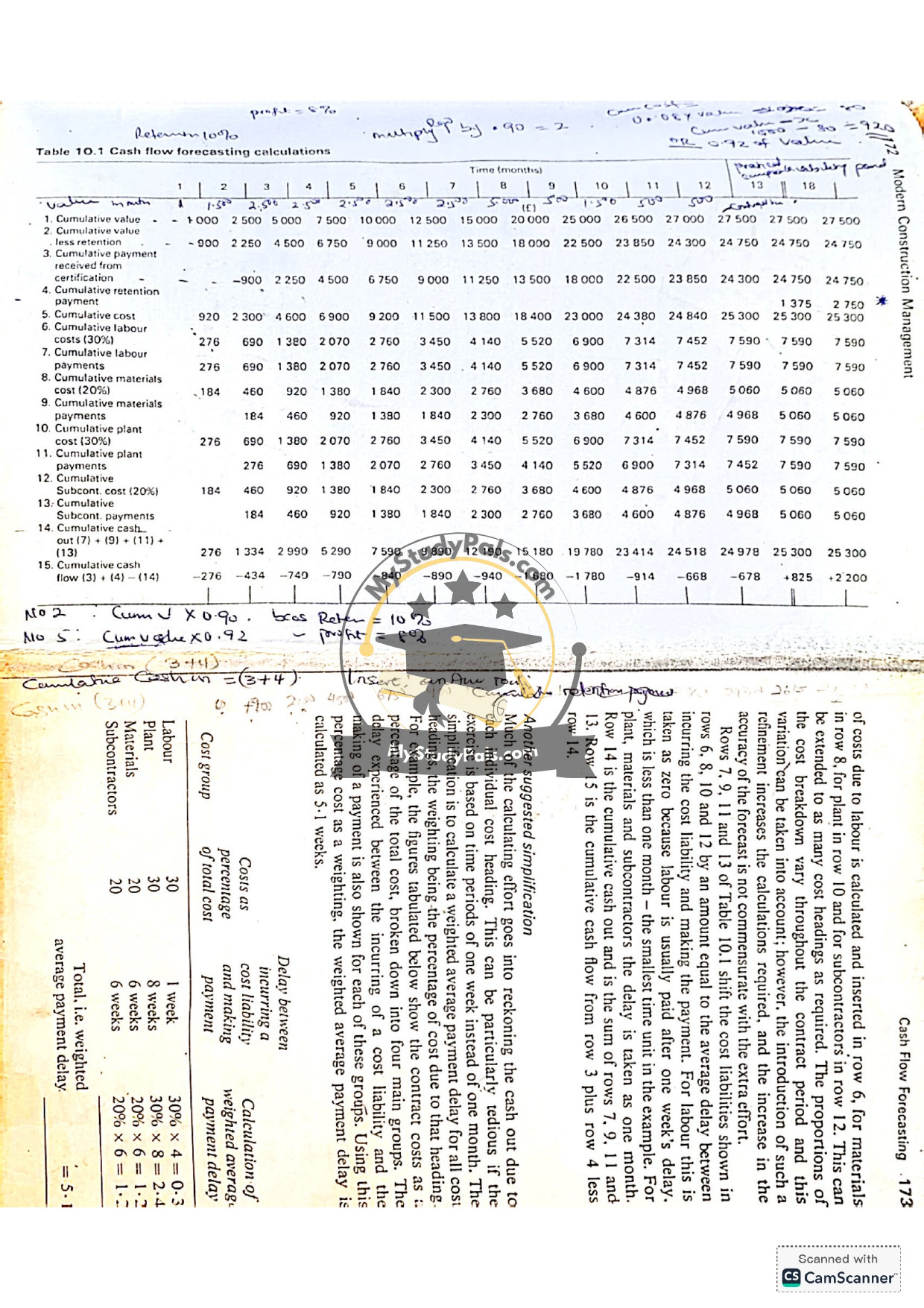

1. Derive cumulative value from the project plan or standard curves.

2. Subtract retention (e.g., 10%) from the cumulative value.

3. Shift the value less retention by the payment delay period.

4. Add cumulative retention repayments at their expected receipt times (e.g., half at one month and half at six months after completion).

5. Calculate cumulative costs for the project, adjusting for non-uniform contribution margins if necessary.

6. Sum cash flows from all projects and add head office outgoings (e.g., rent, salaries) and incomings (e.g., services, claims) to produce the company cash flow.

—

Question 6:

How can computers aid in cash flow forecasting, and what are the benefits?

Answer:

Computers streamline cash flow forecasting by:

– Automating complex calculations for multiple projects.

– Generating inputs (e.g., project duration, value) and outputs (e.g., cash flow tables, graphs) efficiently.

– Enabling scenario analysis, such as evaluating the impact of new projects or contractual changes.

– Reducing manual effort, allowing regular updates (e.g., quarterly or monthly).

Benefits include improved accuracy, time savings, and the ability to make informed decisions based on real-time data.

—

Question 7:

What is “capital lock-up,” and how is the interest on it calculated?

Answer:

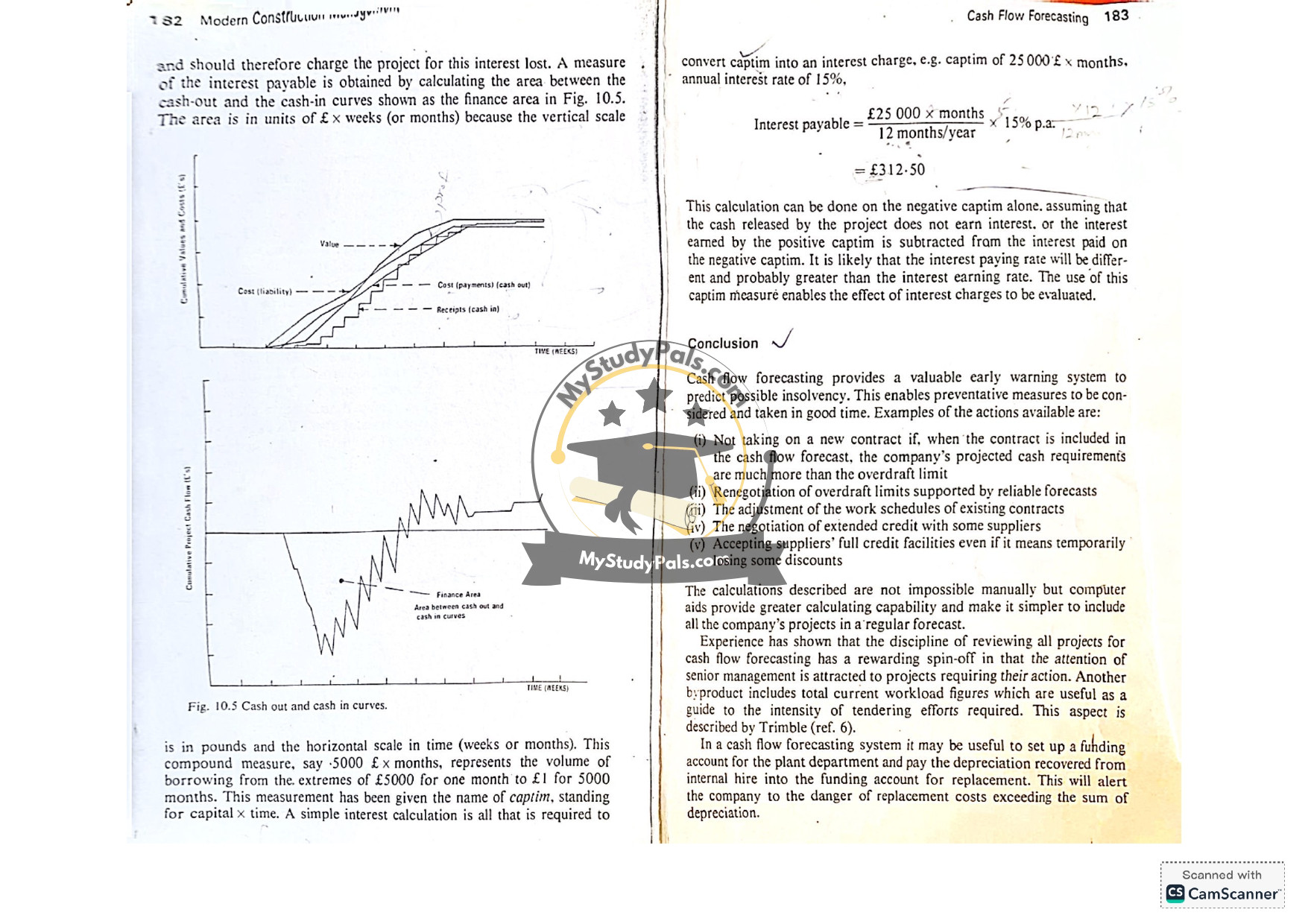

Capital lock-up refers to the negative cash flows in early project stages, where the company’s cash is tied up. Interest is calculated using the “caprim” (capital × time) method:

1. Measure the area between cash-out and cash-in curves (in £ × months).

2. Multiply the caprim by the annual interest rate and divide by 12 (for months).

For example:

– Caprim = 25,000 £ × months.

– Interest = (25,000 / 12) × 15% = £312.50.

This accounts for borrowing costs or lost interest on reserves.

—

Question 8:

What actions can a company take to address predicted cash flow shortages?

Answer:

Actions include:

1. Avoiding new contracts that exceed overdraft limits.

2. Renegotiating overdraft limits with banks using reliable forecasts.

3. Adjusting work schedules on existing projects.

4. Extending credit terms with suppliers.

5. Temporarily forgoing supplier discounts to preserve cash.

These measures help prevent insolvency and maintain financial stability.

—

Question 9:

What additional benefits does cash flow forecasting provide beyond financial planning?

Answer:

Beyond financial planning, cash flow forecasting:

– Attracts senior management’s attention to problematic projects.

– Provides workload insights to guide tendering efforts.

– Supports setting up fidelity accounts for plant depreciation and replacement funding.

– Enhances overall financial discipline and proactive decision-making.

—

Let me know if you’d like any further clarification or additional questions!