ANWSER

—

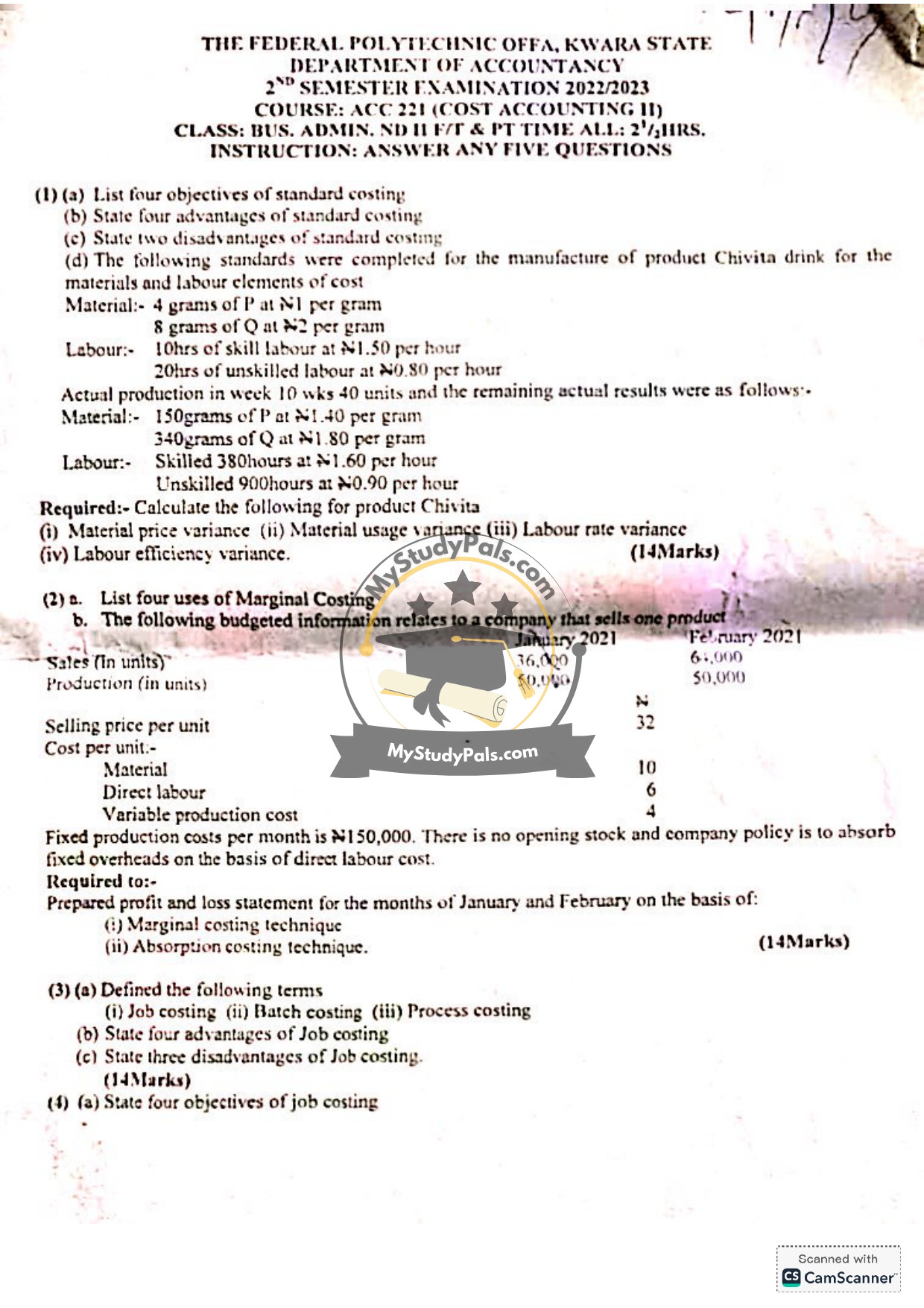

Question 1:

(a) Objectives of standard costing:

1. To establish benchmarks for measuring performance.

2. To control costs by comparing actual costs with standard costs.

3. To assist in budgeting and planning.

4. To facilitate variance analysis and corrective actions.

(b) Advantages of standard costing:

1. Enhances cost control and efficiency.

2. Simplifies inventory valuation.

3. Aids in performance evaluation.

4. Facilitates decision-making and budgeting.

(c) Disadvantages of standard costing:

1. Standards may become outdated due to changes in technology or market conditions.

2. Setting unrealistic standards can demotivate employees.

(d) Calculations for product Chivita:

(i) Material price variance:

– Material P: (Actual Price – Standard Price) × Actual Quantity = (N1.40 – N1) × 150 = N60 (A)

– Material Q: (N1.80 – N2) × 340 = N68 (F)

– Total: N60 (A) + N68 (F) = N8 (F)

(ii) Material usage variance:

– Material P: (Actual Quantity – Standard Quantity) × Standard Price = (150 – 160) × N1 = N10 (F)

– Material Q: (340 – 320) × N2 = N40 (A)

– Total: N10 (F) + N40 (A) = N30 (A)

(iii) Labour rate variance:

– Skilled: (N1.60 – N1.50) × 380 = N38 (A)

– Unskilled: (N0.90 – N0.80) × 900 = N90 (A)

– Total: N38 (A) + N90 (A) = N128 (A)

(iv) Labour efficiency variance:

– Skilled: (380 – 400) × N1.50 = N30 (F)

– Unskilled: (900 – 800) × N0.80 = N80 (A)

– Total: N30 (F) + N80 (A) = N50 (A)

—

Question 2:

(a) Uses of Marginal Costing:

1. Decision-making (e.g., make-or-buy, pricing).

2. Profit planning and break-even analysis.

3. Cost control by focusing on variable costs.

4. Performance evaluation based on contribution margin.

(b) Profit and Loss Statement:

(i) Marginal Costing:

– January:

– Sales: 36,000 × Selling Price

– Variable Costs: 36,000 × (Material + Direct Labour + Variable Production Cost)

– Contribution: Sales – Variable Costs

– Profit: Contribution – Fixed Costs (N150,000)

– February:

– Similar calculation as January for 64,000 units.

(ii) Absorption Costing:

– Fixed overheads absorbed based on direct labour cost.

– Profit calculated after allocating fixed overheads to units produced.

*(Note: Specific numerical answers require the selling price and cost per unit values, which are not provided in the question.)*

—

Question 3:

(a) Definitions:

1. Job costing: Costing method for specific jobs or orders.

2. Batch costing: Costing for identical units produced in batches.

3. Process costing: Costing for continuous mass production.

(b) Advantages of Job Costing:

1. Accurate cost tracking per job.

2. Helps in pricing decisions.

3. Useful for customized production.

4. Facilitates profitability analysis per job.

(c) Disadvantages of Job Costing:

1. Complex and time-consuming.

2. High administrative costs.

3. Not suitable for mass production.

—

Question 4:

(a) Objectives of Job Costing:

1. To determine the cost of each job.

2. To control job-related costs.

3. To assist in pricing decisions.

4. To evaluate job profitability.

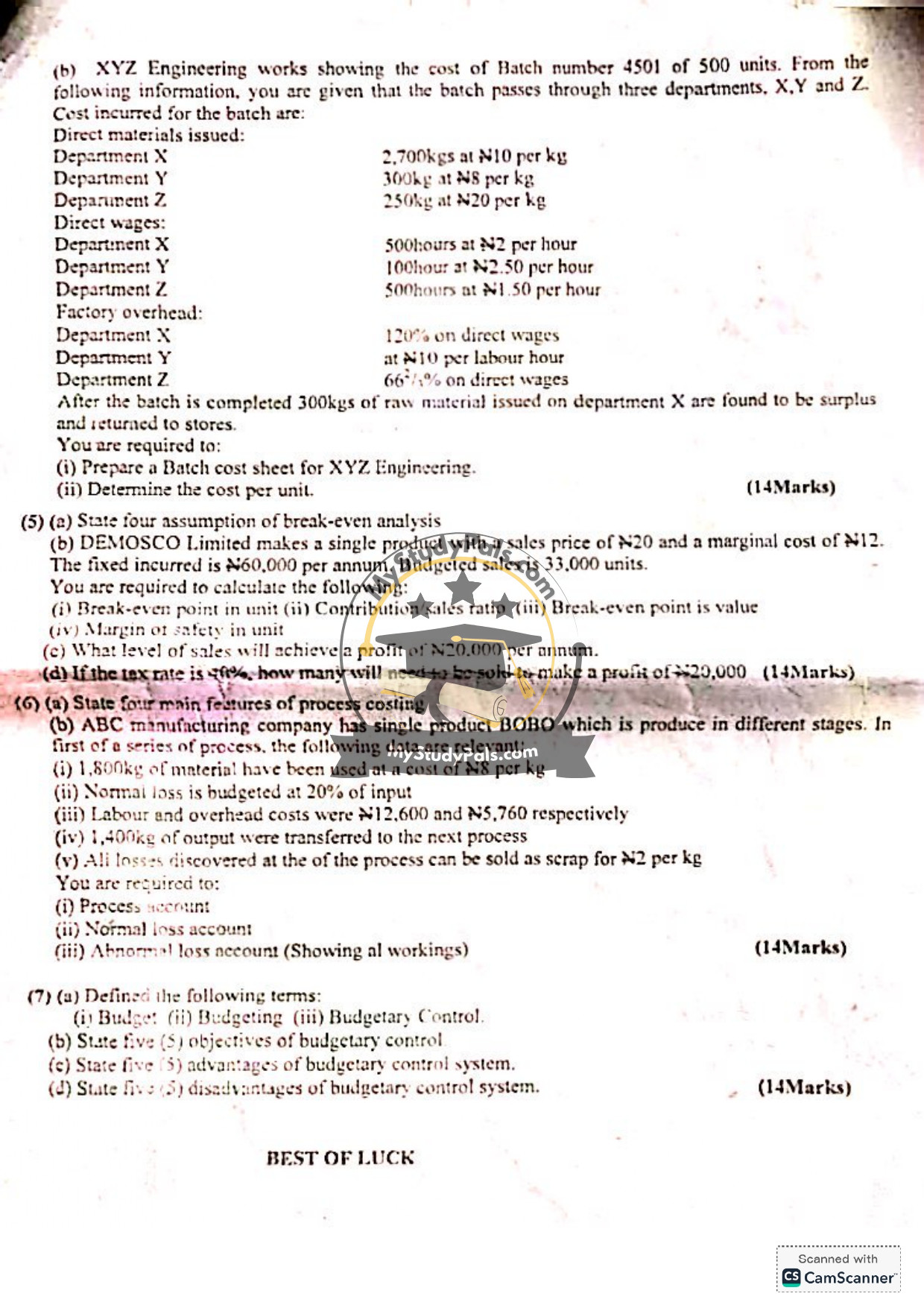

(b) Batch Cost Sheet for XYZ Engineering:

– Direct Materials:

– X: 2,700kg × N10 = N27,000

– Y: 300kg × N8 = N2,400

– Z: 250kg × N20 = N5,000

– Less surplus: 300kg × N10 = N3,000

– Total Materials: N31,400

– Direct Wages:

– X: 500hrs × N2 = N1,000

– Y: 100hrs × N2.50 = N250

– Z: 500hrs × N1.50 = N750

– Total Wages: N2,000

– Factory Overhead:

– X: 120% of N1,000 = N1,200

– Y: 100hrs × N10 = N1,000

– Z: 66⅔% of N750 = N500

– Total Overhead: N2,700

– Total Batch Cost: N31,400 + N2,000 + N2,700 = N36,100

– Cost per Unit: N36,100 ÷ 500 units = N72.20

—

Question 5:

(a) Assumptions of Break-even Analysis:

1. Fixed costs remain constant.

2. Variable costs vary linearly with production.

3. Selling price per unit is constant.

4. Only one product is produced.

(b) Calculations for DEMOSCO Limited:

– (i) Break-even point (units): Fixed Costs ÷ Contribution per Unit = N60,000 ÷ (N20 – N12) = 7,500 units

– (ii) Contribution/Sales Ratio: (N20 – N12) ÷ N20 = 40%

– (iii) Break-even point (value): 7,500 units × N20 = N150,000

– (iv) Margin of Safety (units): Budgeted Sales – Break-even Sales = 33,000 – 7,500 = 25,500 units

(c) Sales for N20,000 Profit:

– Required Profit = (Fixed Costs + Desired Profit) ÷ Contribution per Unit = (N60,000 + N20,000) ÷ N8 = 10,000 units

(d) Sales for N20,000 Profit after 50% Tax:

– Pre-tax Profit Needed = N20,000 ÷ (1 – 0.5) = N40,000

– Required Sales = (N60,000 + N40,000) ÷ N8 = 12,500 units

—

Question 6:

(a) Features of Process Costing:

1. Continuous production.

2. Costs averaged over units.

3. Output includes normal and abnormal losses.

4. Used in industries like chemicals and food processing.

(b) Process Accounts for ABC Manufacturing:

– Process Account:

– Input: 1,800kg × N8 = N14,400

– Labour: N12,600

– Overhead: N5,760

– Total Cost: N32,760

– Output: 1,400kg (transferred)

– Normal Loss: 360kg × N2 = N720

– Abnormal Loss: 40kg (calculated)

– Normal Loss Account:

– Debit: 360kg × N2 = N720

– Credit: Scrap value recorded.

– Abnormal Loss Account:

– Calculated as (Total Cost – Normal Loss) ÷ Actual Output = (N32,760 – N720) ÷ 1,400 = N22.89 per kg

– Abnormal Loss: 40kg × N22.89 = N915.60

—

Question 7:

(a) Definitions:

1. Budget: A financial plan for future activities.

2. Budgeting: The process of preparing budgets.

3. Budgetary Control: Monitoring and controlling budgets to achieve goals.

(b) Objectives of Budgetary Control:

1. To plan and coordinate activities.

2. To control costs and resources.

3. To evaluate performance.

4. To ensure financial discipline.

5. To facilitate communication.

(c) Advantages of Budgetary Control:

1. Improves efficiency.

2. Enhances goal alignment.

3. Aids in resource allocation.

4. Provides a performance benchmark.

5. Encourages forward planning.

(d) Disadvantages of Budgetary Control:

1. Rigidity in operations.

2. Time-consuming to prepare.

3. May lead to conflicts.

4. Dependence on accurate data.

5. Can demotivate if unrealistic.

—