ANSWER

Here are the answers to your exam questions:

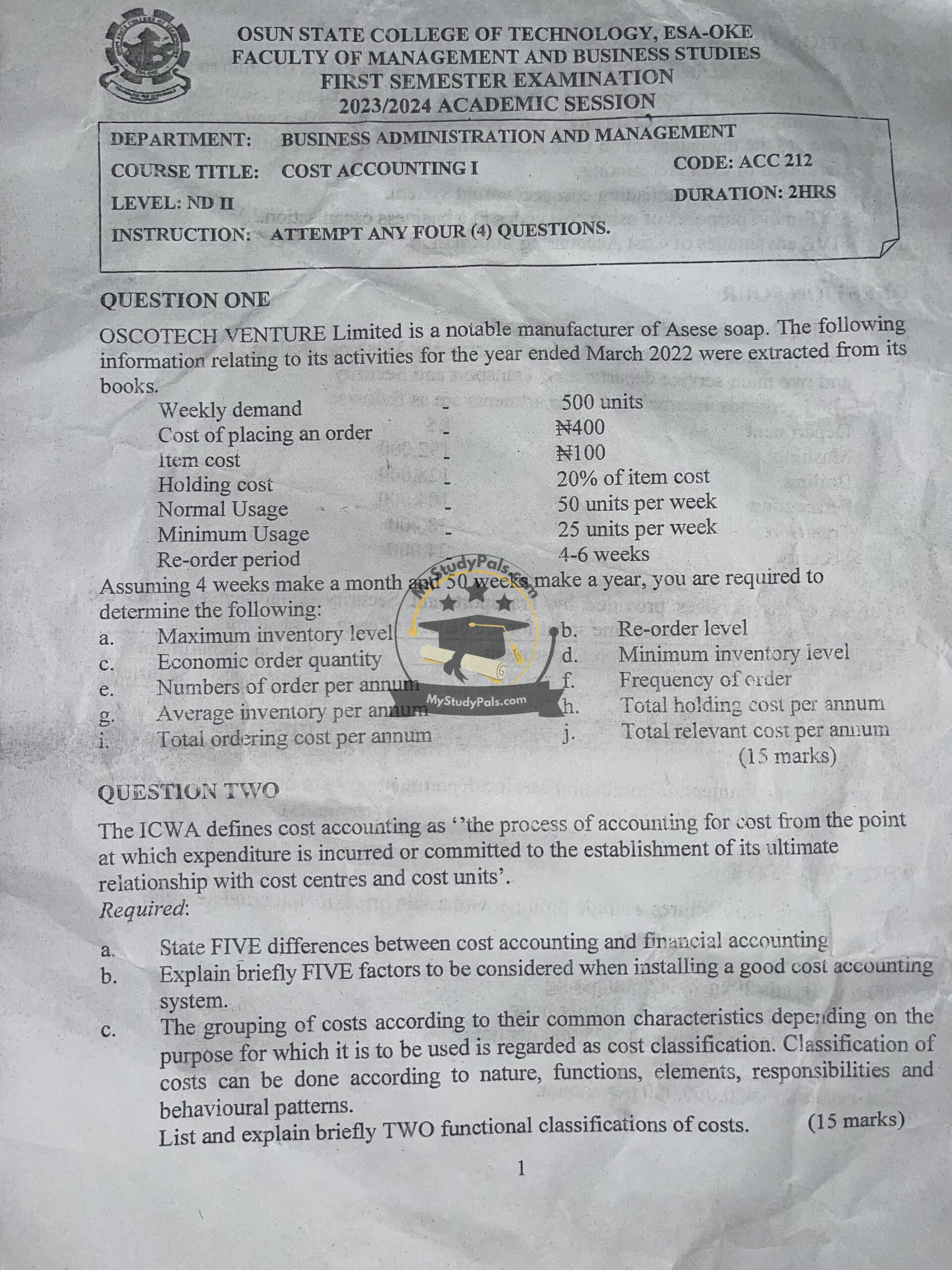

Question 1:

a. Maximum Inventory Level

Maximum Inventory Level=Reorder Level+Economic Order Quantity−(Minimum Usage × Minimum Reorder Period)\text{Maximum Inventory Level} = \text{Reorder Level} + \text{Economic Order Quantity} – \text{(Minimum Usage × Minimum Reorder Period)}

b. Economic Order Quantity (EOQ)

EOQ=2DSHEOQ = \sqrt{\frac{2DS}{H}}

where:

- DD = Annual Demand = 500×50=25,000500 \times 50 = 25,000 units

- SS = Cost of Placing an Order = ₦400

- HH = Holding Cost per Unit = 20%20\% of ₦100 = ₦20

EOQ=2×25,000×40020=1,000,000=1,000 unitsEOQ = \sqrt{\frac{2 \times 25,000 \times 400}{20}} = \sqrt{1,000,000} = 1,000 \text{ units}

c. Number of Orders per Annum

Number of Orders=Annual DemandEOQ=25,0001,000=25 orders\text{Number of Orders} = \frac{\text{Annual Demand}}{\text{EOQ}} = \frac{25,000}{1,000} = 25 \text{ orders}

d. Minimum Inventory Level

Minimum Inventory Level=(Minimum Usage×Maximum Reorder Period)\text{Minimum Inventory Level} = (\text{Minimum Usage} \times \text{Maximum Reorder Period}) =25×6=150 units= 25 \times 6 = 150 \text{ units}

e. Frequency of Order

Frequency=Number of OrdersWeeks per Year=2550=0.5 (every 2 weeks)\text{Frequency} = \frac{\text{Number of Orders}}{\text{Weeks per Year}} = \frac{25}{50} = 0.5 \text{ (every 2 weeks)}

f. Average Inventory Per Annum

Average Inventory=EOQ2+Safety Stock\text{Average Inventory} = \frac{EOQ}{2} + \text{Safety Stock} =1,0002+150=500+150=650 units= \frac{1,000}{2} + 150 = 500 + 150 = 650 \text{ units}

g. Total Holding Cost Per Annum

Total Holding Cost=Average Inventory×H\text{Total Holding Cost} = \text{Average Inventory} \times H =650×20=₦13,000= 650 \times 20 = ₦13,000

h. Total Ordering Cost Per Annum

Total Ordering Cost=Number of Orders×Cost per Order\text{Total Ordering Cost} = \text{Number of Orders} \times \text{Cost per Order} =25×400=₦10,000= 25 \times 400 = ₦10,000

i. Total Relevant Cost Per Annum

Total Relevant Cost=Total Holding Cost+Total Ordering Cost\text{Total Relevant Cost} = \text{Total Holding Cost} + \text{Total Ordering Cost} =₦13,000+₦10,000=₦23,000= ₦13,000 + ₦10,000 = ₦23,000

Question 2:

a. Five Differences Between Cost Accounting and Financial Accounting

- Purpose: Cost accounting is for internal decision-making, while financial accounting is for external reporting.

- Users: Cost accounting is used by managers, while financial accounting is used by shareholders, creditors, etc.

- Legal Requirement: Cost accounting is not mandatory, while financial accounting is legally required.

- Time Focus: Cost accounting focuses on present and future costs, while financial accounting records past transactions.

- Reporting Format: Cost accounting reports are flexible, while financial accounting follows strict standards.

b. Five Factors to Consider When Installing a Cost Accounting System

- Nature of Business

- Objectives of the System

- Cost of Installation

- Capabilities of the Staff

- Integration with Other Systems

c. Two Functional Classifications of Costs

- Fixed Costs – Costs that do not change with production volume, e.g., rent, salaries.

- Variable Costs – Costs that vary directly with production, e.g., raw materials, direct labor.

Question 3:

a. Definition of Cost Accounting

Cost accounting is the process of recording, analyzing, and allocating costs to determine the cost of products and services for decision-making.

b. Three Aims of Establishing a Cost Accounting System

- Cost Control

- Price Determination

- Profitability Analysis

c. Five Main Purposes of Using Cost Codes in Business

- Tracking Expenses

- Budgeting and Planning

- Cost Allocation

- Identifying Inefficiencies

- Improving Financial Reporting

d. Five Advantages of Cost Accounting Information

- Helps in Cost Reduction

- Improves Decision Making

- Enhances Budgeting and Planning

- Assists in Pricing Strategies

- Aids in Performance Evaluation

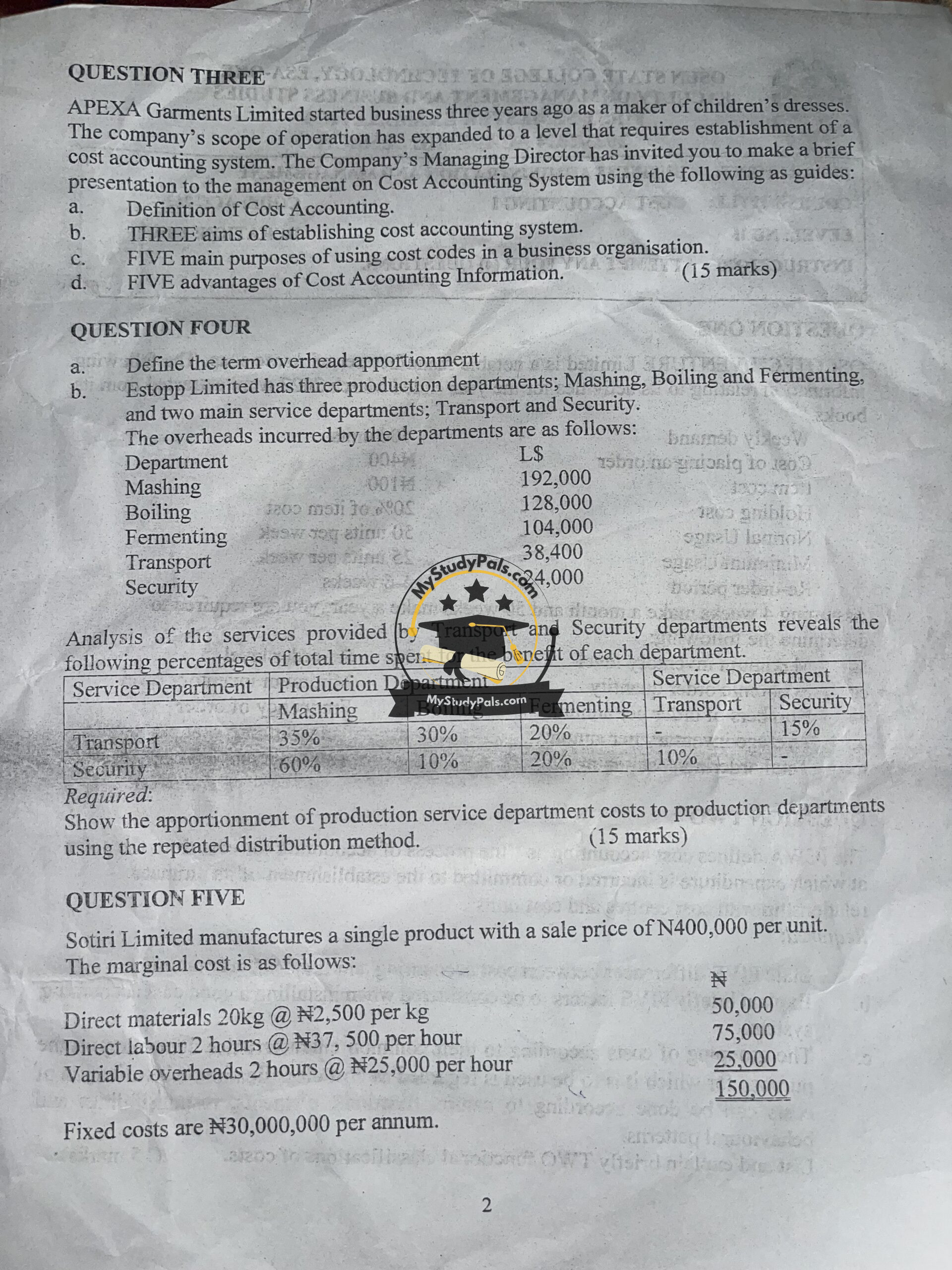

Question 4:

a. Definition of Overhead Apportionment

Overhead apportionment is the process of distributing indirect costs among different departments based on appropriate criteria.

b. Repeated Distribution Method

The costs of service departments (Transport & Security) will be apportioned to production departments (Mashing, Boiling, Fermenting) using the given percentages.

Question 5:

a. Break-even Analysis Calculations

- Break-even Point (Units)

Break-even Units=Fixed CostsSelling Price per Unit−Variable Cost per Unit\text{Break-even Units} = \frac{\text{Fixed Costs}}{\text{Selling Price per Unit} – \text{Variable Cost per Unit}} =30,000,000400,000−150,000=30,000,000250,000=120 units= \frac{30,000,000}{400,000 – 150,000} = \frac{30,000,000}{250,000} = 120 \text{ units}

- Sales at Break-even Point

=120×400,000=₦48,000,000= 120 \times 400,000 = ₦48,000,000

- C/S Ratio

C/S Ratio=Selling Price per Unit−Variable Cost per UnitSelling Price per Unit\text{C/S Ratio} = \frac{\text{Selling Price per Unit} – \text{Variable Cost per Unit}}{\text{Selling Price per Unit}} =250,000400,000=0.625= \frac{250,000}{400,000} = 0.625

- Units to Achieve Profit of ₦40,000,000

=30,000,000+40,000,000250,000=70,000,000250,000=280 units= \frac{30,000,000 + 40,000,000}{250,000} = \frac{70,000,000}{250,000} = 280 \text{ units}

- Units to Achieve After-tax Profit of ₦21,000,000

Before-tax Profit=21,000,0001−0.30=21,000,0000.70=₦30,000,000\text{Before-tax Profit} = \frac{21,000,000}{1 – 0.30} = \frac{21,000,000}{0.70} = ₦30,000,000 =30,000,000+30,000,000250,000=60,000,000250,000=240 units= \frac{30,000,000 + 30,000,000}{250,000} = \frac{60,000,000}{250,000} = 240 \text{ units}

b. Four Uses of Cost Volume Profit (CVP) Analysis

- Determining Break-even Point

- Setting Sales Targets

- Decision-making for Pricing Strategies

- Analyzing Profitability Scenarios

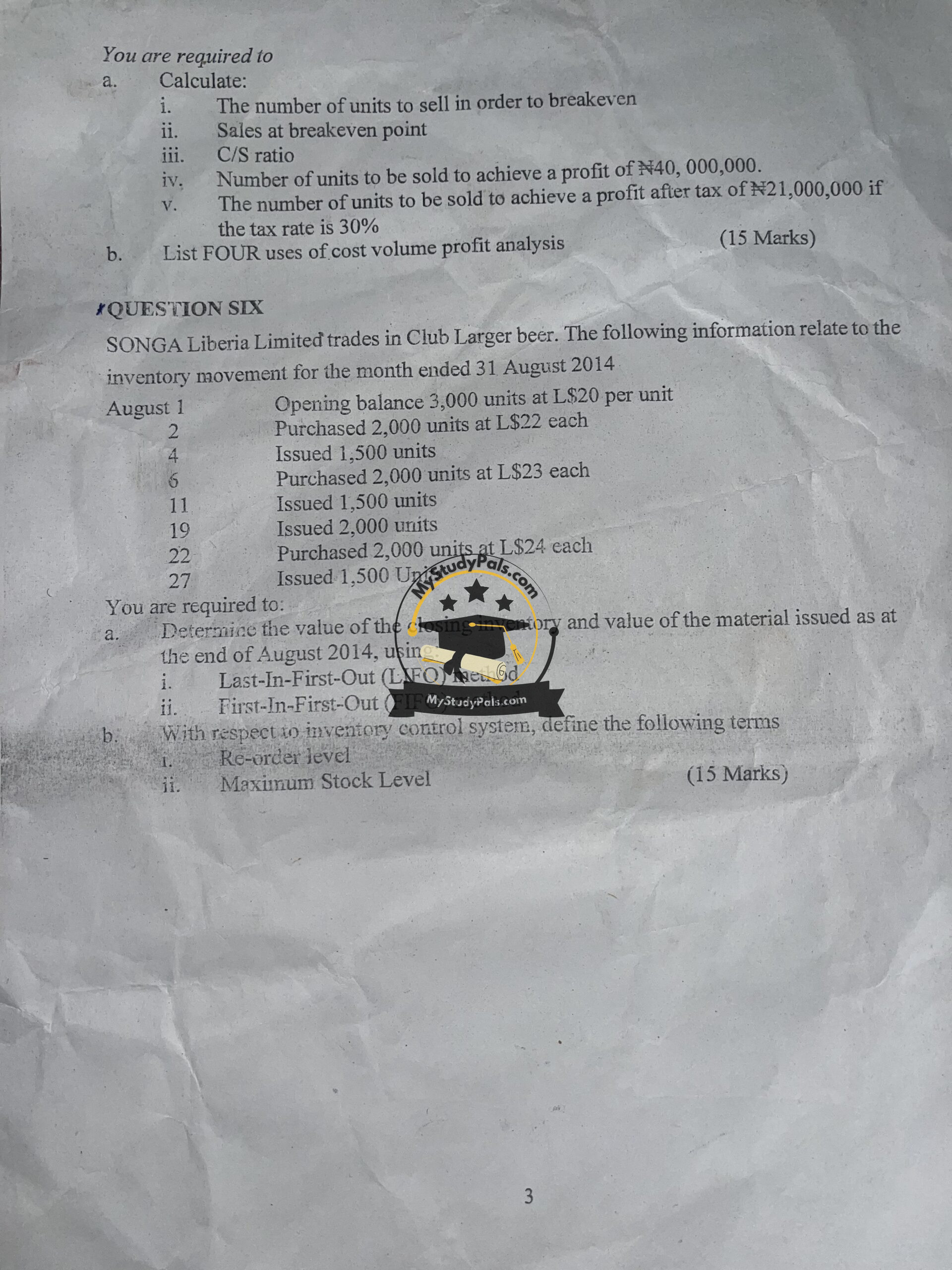

Question 6:

a. Closing Inventory Valuation Using LIFO & FIFO

- LIFO Method: Last purchases are issued first, so closing inventory consists of the oldest purchases.

- FIFO Method: Oldest purchases are issued first, so closing inventory consists of the latest purchases.

b. Definitions of Inventory Control Terms

- Reorder Level: The stock level at which new inventory should be ordered to avoid stockouts.

- Maximum Stock Level: The highest quantity of inventory that should be kept to prevent overstocking.