ANWSER

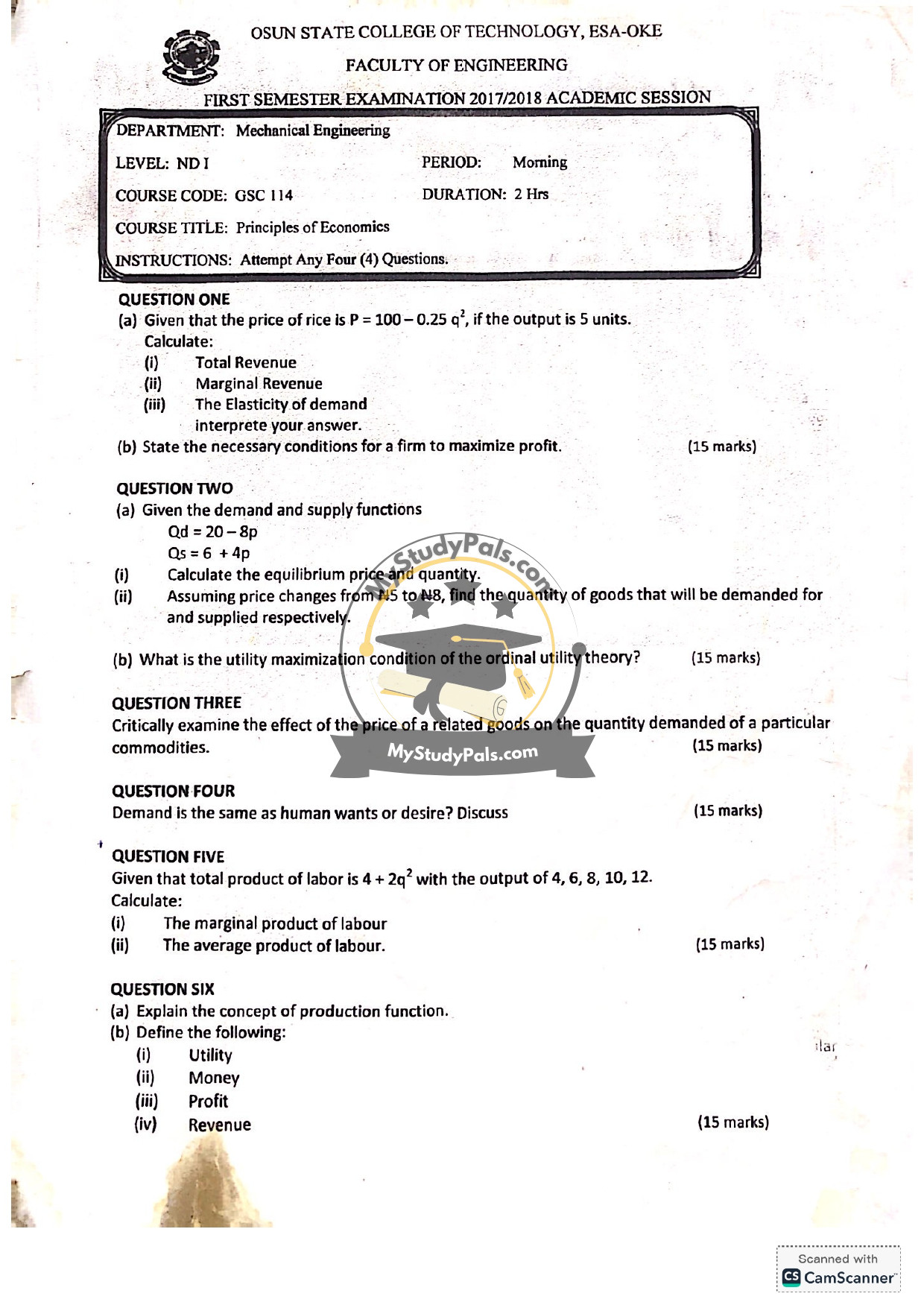

Question One:

(a) Given \( P = 100 – 0.25q^2 \) and \( q = 5 \):

(i) Total Revenue (TR):

\[ TR = P \times q = (100 – 0.25 \times 5^2) \times 5 = (100 – 6.25) \times 5 = 93.75 \times 5 = 468.75 \]

(ii) Marginal Revenue (MR):

First, find the derivative of TR with respect to \( q \):

\[ TR = P \times q = (100 – 0.25q^2) \times q = 100q – 0.25q^3 \]

\[ MR = \frac{d(TR)}{dq} = 100 – 0.75q^2 \]

At \( q = 5 \):

\[ MR = 100 – 0.75 \times 25 = 100 – 18.75 = 81.25 \]

(iii) Elasticity of Demand (Ed):

\[ Ed = \frac{dq}{dP} \times \frac{P}{q} \]

First, find \( \frac{dP}{dq} = -0.5q \), so \( \frac{dq}{dP} = \frac{1}{-0.5q} \).

At \( q = 5 \), \( P = 93.75 \):

\[ Ed = \frac{1}{-2.5} \times \frac{93.75}{5} = -0.4 \times 18.75 = -7.5 \]

Interpretation: The demand is elastic since \( |Ed| > 1 \).

(b) Conditions for Profit Maximization:

1. Marginal Revenue (MR) must equal Marginal Cost (MC).

2. The MC curve must intersect the MR curve from below.

—

Question Two:

(a) Given \( Qd = 20 – 8p \) and \( Qs = 6 + 4p \):

(i) Equilibrium Price and Quantity:

Set \( Qd = Qs \):

\[ 20 – 8p = 6 + 4p \]

\[ 14 = 12p \]

\[ p = \frac{14}{12} = 1.17 \]

Substitute \( p \) into \( Qd \) or \( Qs \):

\[ Q = 20 – 8 \times 1.17 = 20 – 9.36 = 10.64 \]

(ii) Price Change from \( N_5 \) to \( N_8 \):

At \( p = 5 \):

\[ Qd = 20 – 8 \times 5 = -20 \] (Not realistic, likely a typo in the question.)

At \( p = 8 \):

\[ Qd = 20 – 8 \times 8 = -44 \]

Similarly, for supply:

At \( p = 5 \):

\[ Qs = 6 + 4 \times 5 = 26 \]

At \( p = 8 \):

\[ Qs = 6 + 4 \times 8 = 38 \]

(b) Utility Maximization Condition (Ordinal Utility Theory):

The consumer maximizes utility when the marginal rate of substitution (MRS) between two goods equals the ratio of their prices, i.e., \( MRS = \frac{P_x}{P_y} \).

—

Question Three:

The price of related goods affects the quantity demanded of a commodity in two ways:

1. Substitute Goods: An increase in the price of a substitute good (e.g., tea for coffee) leads to higher demand for the commodity.

2. Complementary Goods: An increase in the price of a complementary good (e.g., petrol for cars) reduces the demand for the commodity.

The cross-price elasticity of demand measures this relationship.

—

Question Four:

Demand is not the same as human wants or desires. Demand refers to the quantity of a good or service that consumers are willing and able to purchase at a given price and time, backed by purchasing power. Wants or desires are unlimited and not necessarily tied to the ability to pay.

—

Question Five:

Given total product \( TP = 4 + 2q^2 \) and outputs \( q = 4, 6, 8, 10, 12 \):

(i) Marginal Product of Labour (MPL):

\[ MPL = \frac{d(TP)}{dq} = 4q \]

For \( q = 4 \): \( MPL = 16 \); \( q = 6 \): \( MPL = 24 \); etc.

(ii) Average Product of Labour (APL):

\[ APL = \frac{TP}{q} = \frac{4 + 2q^2}{q} \]

For \( q = 4 \): \( APL = \frac{4 + 32}{4} = 9 \); \( q = 6 \): \( APL = \frac{4 + 72}{6} = 12.67 \); etc.

—

Question Six:

(a) Production Function: A mathematical relationship showing the maximum output produced from a given set of inputs (e.g., labor, capital) with current technology.

(b) Definitions:

(i) Utility: The satisfaction or benefit derived from consuming a good or service.

(ii) Money: A medium of exchange, store of value, and unit of account.

(iii) Profit: The financial gain when total revenue exceeds total cost.

(iv) Revenue: The total income received from selling goods or services, calculated as price times quantity.

—