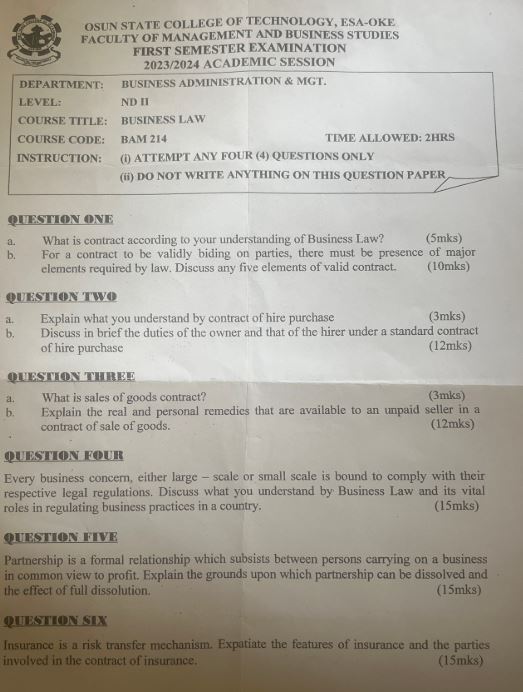

COURSE TITLE: BUSINESS LAW

COURSE CODE: BAM 214

DURATION: 2 Hours

Instructions

(i) ATTEMPT ANY FOUR (4) QUESTIONS ONLY

(ii) DO NOT WRITE ANYTHING ON THIS QUESTION PAPER

Question 1a: What is a contract according to your understanding of Business Law? (5 marks)

Question 1b: For a contract to be validly binding on parties, there must be the presence of major elements required by law. Discuss any five elements of a valid contract. (10 marks)

Question 2a: Explain what you understand by a contract of hire purchase. (2 marks)

Question 2b: Discuss in brief the duties of the owner and that of the hirer under a standard contract of hire purchase. (12 marks)

Question 3a: What is a sales of goods contract? (2 marks)

Question 3b: Explain the real and personal remedies that are available to an unpaid seller in a contract of sale of goods. (12 marks)

Question 4: Every business concern, either large-scale or small-scale, is bound to comply with their respective legal regulations. Discuss what you understand by Business Law and its vital roles in regulating business practices in a country. (15 marks)

Question 5: Partnership is a formal relationship which subsists between persons carrying on a business in common view to profit. Explain the grounds upon which partnership can be dissolved and the effect of full dissolution. (15 marks)

Question 6: Insurance is a risk transfer mechanism. Expaiate the features of insurance and the parties involved in the contract of insurance. (15 marks)

Answers

Answer 1a:

A contract, in the context of Business Law, is a legally binding agreement between two or more parties that creates mutual obligations enforceable by law. For a contract to be valid, it must involve an offer, acceptance, consideration, and the intention to create legal relations. Contracts can be written, oral, or implied by conduct, but written contracts are generally preferred for clarity and evidence.

A contract, in the context of Business Law, is a legally binding agreement between two or more parties that creates mutual obligations enforceable by law. For a contract to be valid, it must involve an offer, acceptance, consideration, and the intention to create legal relations. Contracts can be written, oral, or implied by conduct, but written contracts are generally preferred for clarity and evidence.

Answer 1b:

- Offer and Acceptance: There must be a clear offer by one party and an unequivocal acceptance by the other. The offer must be communicated, and the acceptance must mirror the terms of the offer.

- Consideration: This refers to something of value exchanged between the parties. It can be money, goods, services, or a promise to do or refrain from doing something. Consideration must be sufficient but need not be adequate.

- Intention to Create Legal Relations: The parties must intend for the agreement to be legally binding. Social or domestic agreements usually lack this intention unless explicitly stated.

- Capacity: The parties involved must have the legal capacity to enter into a contract. This means they must be of sound mind, of legal age, and not disqualified by law (e.g., bankrupt individuals).

- Legality of Purpose: The contract’s purpose must be legal. Agreements to commit illegal acts or those against public policy are not enforceable.

Answer 2a:

A hire purchase contract is an agreement where a person (hirer) hires goods with the option to purchase them after a specified period. The hirer pays in installments, and ownership transfers only after the final payment.

A hire purchase contract is an agreement where a person (hirer) hires goods with the option to purchase them after a specified period. The hirer pays in installments, and ownership transfers only after the final payment.

Answer 2b:

Duties of the Owner:

Duties of the Owner:

- Delivery of Goods: The owner must deliver the goods to the hirer as agreed.

- Right to Repossess: If the hirer defaults, the owner can repossess the goods.

- Warranty: The owner must ensure the goods are of merchantable quality and fit for purpose.

Duties of the Hirer:

- Payment of Installments: The hirer must pay the agreed installments on time.

- Care of Goods: The hirer must take reasonable care of the goods.

- Return of Goods: If the hirer chooses not to purchase, they must return the goods in good condition.

Answer 3a:

A sales of goods contract is an agreement where the seller transfers or agrees to transfer the ownership of goods to the buyer in exchange for a price. It is governed by the Sale of Goods Act.

A sales of goods contract is an agreement where the seller transfers or agrees to transfer the ownership of goods to the buyer in exchange for a price. It is governed by the Sale of Goods Act.

Answer 3b:

Real Remedies:

Real Remedies:

- Right of Lien: The seller can retain possession of the goods until payment is made.

- Right of Stoppage in Transit: If the buyer becomes insolvent, the seller can stop the goods while in transit.

- Right of Resale: The seller can resell the goods if the buyer defaults.

Personal Remedies:

- Suit for Price: The seller can sue the buyer for the price of the goods.

- Damages for Non-Acceptance: The seller can claim damages if the buyer refuses to accept the goods.

- Interest: The seller can claim interest on the unpaid price.

Answer 4:

Business Law refers to the body of law that governs business and commercial transactions. It includes laws related to contracts, sales, partnerships, corporations, and more. Roles of Business Law:

Business Law refers to the body of law that governs business and commercial transactions. It includes laws related to contracts, sales, partnerships, corporations, and more. Roles of Business Law:

- Regulation of Business Practices: Ensures businesses operate within legal frameworks, promoting fairness and transparency.

- Consumer Protection: Protects consumers from unfair practices, ensuring they receive quality goods and services.

- Dispute Resolution: Provides mechanisms for resolving disputes between businesses and between businesses and consumers.

- Promotion of Ethical Standards: Encourages ethical behavior and corporate social responsibility.

- Economic Stability: Helps maintain economic stability by regulating financial transactions and preventing fraud.

Answer 5:

Grounds for Dissolution:

Grounds for Dissolution:

- By Agreement: Partners may agree to dissolve the partnership.

- Expiry of Term: If the partnership was for a fixed term, it dissolves at the end of that term.

- Completion of Venture: If the partnership was for a specific venture, it dissolves upon completion.

- Death or Bankruptcy: The death or bankruptcy of a partner can lead to dissolution.

- Illegality: If the business becomes illegal, the partnership must dissolve.

Effects of Dissolution:

- Cessation of Business: The partnership ceases to carry on business.

- Settlement of Accounts: Assets are liquidated, and liabilities are settled.

- Distribution of Surplus: Any remaining assets are distributed among partners according to their shares.

- Termination of Authority: Partners lose the authority to bind the partnership.

Answer 6:

Features of Insurance:

Features of Insurance:

- Risk Transfer: The insured transfers the risk of loss to the insurer.

- Pooling of Risks: Premiums from many insureds are pooled to pay for the losses of a few.

- Indemnity: The insurer compensates the insured for actual losses suffered.

- Utmost Good Faith: Both parties must disclose all relevant information honestly.

- Insurable Interest: The insured must have a financial interest in the subject matter.

Parties Involved:

- Insurer: The company that provides insurance coverage.

- Insured: The individual or entity that purchases the insurance policy.

- Beneficiary: The person or entity entitled to receive the insurance proceeds.

- Agent/Broker: Intermediaries who facilitate the insurance contract between the insurer and the insured.