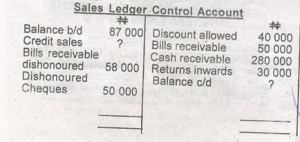

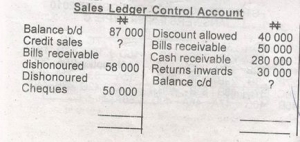

Given:

Determine the balance

- A. 415,000 debit

- B. 215,000 credit

- C. 215,000 debit

- D. 315,000

Calculate the cost of goods sold.

- A. N61 000

- B. N58 000

- C. N62000

- D. N57 000

Find the average stock for the period

- A. N27 000

- B. N23 000

- C. N28 000

- D. N20 500

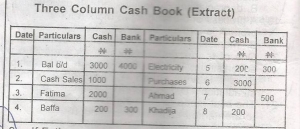

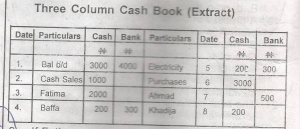

Calculate the cash balance after the discount

- A. N2760

- B. N4 300

- C. N6 200

- D. N2.400

If Fatima was granted a discount of 2% what will be discount allowed?

- A. N20

- B. N40

- C. N60

- D. N4

When Your Silence Is Loud..& Your Eyes Speaking Volumes..

Calculate the value of credit sales

- A. N484 000

- B. N448000

- C. N584 000

- D. N558 000

Credit sales is given at 160% of cash received.

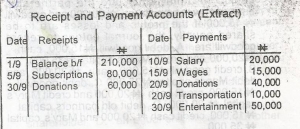

What is the balance c/d?

debit 64300

- A. N333 000

- B. N234 000

- C. N343 000

- D. N243 000

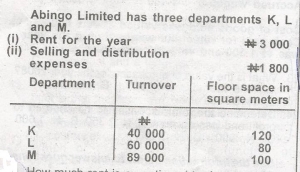

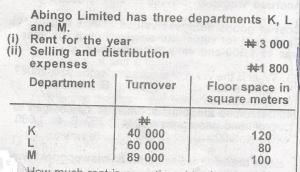

How much selling and distribution expenses is apportioned to department M?

- A. N 800

- B. N 600

- C. N400

- D. N1800

How much rent is apportioned to department K?

- A. N1200

- B. N1800

- C. N2000

- D. N750

Use the information to answer the question.

……………………..30/9/06…….30/9/07…..

……………………….N………….N………

Accrued insurance premium…600………..710…….

Prepaid rent income………490…………630……

The cash book includes N1,850 and N,2,100 in respect of insurance premium and rent income respectively.

What amount is to be credited to the profit and loss account in respect of rent income?

- A. N1,710

- B. N1760

- C. N2000

- D. N2240

Use the information to answer the question.

……………………………………………30/9/06…….30/9/07…..

……………………………………………….N………….N………

Accrued insurance premium……..600………..710…….

Prepaid rent income………………..490…………630……

The cash book includes N1,850 and N,2,100 with respect to insurance premium and rent income respectively.

The insurance premium to be taken to the profit and loss account would be.

- A. N1,310

- B. N1,850

- C. N1,990

- D. 2,210

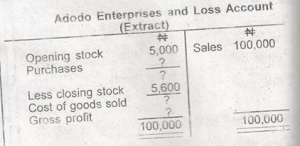

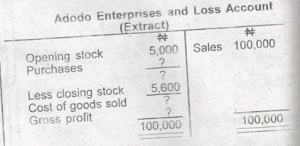

If the opening stock is 5% of sales. calculate the purchases

- A. N95,600

- B. N95,000

- C. N90,600

- D. N85,000

If the gross profit margin is 10% of sales, what is the value of the cost of goods sold?

- A. N10,000

- B. N90,000

- C. N105,600

- D. N110,000

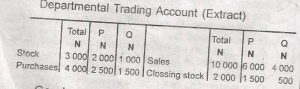

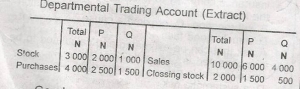

Goods worth N300 was transferred from department Q to P Similarly, P’s total expenses for the period was N200

Department P’s net profit was

- A. N5 200

- B. N3000

- C. N2800

- D. N2 500

Goods worth N300 was transferred from department Q to P Similarly, P’s total expenses for the period was N200

What was department Q’s gross profit?

- A. N2 500

- B. N2 300

- C. N 2 200

- D. N1700

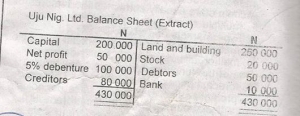

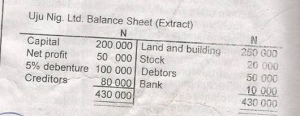

Which of the following is true of Uju Nig.Ltd?

- A. It is a highly geared company

- B. It has no liquidity problem in the short term

- C. It is adequately secured in fixed assets

- D. It's working capital is zero

Give:

1. Ascertainment of the particulars of the proposed company

II. Preparation of the incorporation documents

III. Filling of the documents

IV. Registration of the company

From the information above, the stages involved in the formation of a company are

- A. I, II and III

- B. I, II, III and IV

- C. I,IIand IV

- D. II, III and IV

Use this information below to answer this question.

Trading Account (Extract)

……………..N………………………..N……

Opening stock…19500……..Sales…………96 000..

Add purchases…68700……………………………

…………….88200……………………………

Less closing stock..?……………………………

Cost of goods sold..?……………………………

Gross profit C/D….?……………………………

………………..?……………………..?……

The gross profit margin is 20%

Determine the closing stock

- A. N76 800

- B. N67 800

- C. N14 100

- D. N11 400

Use this information below to answer this question.

Trading Account (Extract)

……………..N………………………..N……

Opening stock…19500……..Sales…………96 000..

Add purchases…68700……………………………

…………….88200……………………………

Less closing stock..?……………………………

Cost of goods sold..?……………………………

Gross profit C/D….?……………………………

………………..?……………………..?……

The gross profit margin is 20%

What is the gross profit?

- A. N88 200

- B. N76 800

- C. N 19 200

- D. N12 900

Given that the balance as per cash book after adjustment was N6315, nu-presented cheques N1000 and the bank statement balance N3240. What was the balance of the nu-credited cheques?

- A. N4075

- B. N4240

- C. N3315

- D. N3075