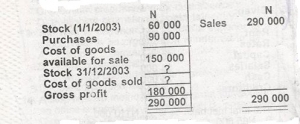

Musa merchants Trading and profit and Loss Account for the year ended Dec.31st, 2003

Determine the closing stock

- A. N20 000

- B. N30, 000

- C. N40 000

- D. N50,000

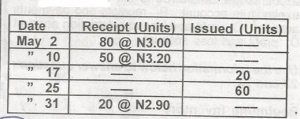

Based on the FIFO method of valuation the total cost of the raw materials issued is

- A. N150

- B. N160

- C. N240

- D. N250

WHAT IS THE VALUE OF RAW MATERIALS ISSUED ON MAY 17TH BASED ON THE LIFO METHOD?

- A. N60

- B. N61

- C. N62

- D. N64

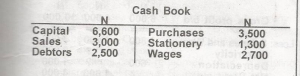

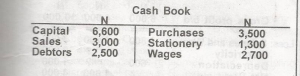

The owner wishes to maintain an amount equal to \( \frac{1}{3} \)

of capital as drawings.

The cash book closing balance will be

- A. N900

- B. N2,400

- C. N4,200

- D. N4,600

The owner wishes to maintain an amount equal to \( \frac{1}{3} \)

of capital as drawings.

The amount withdrawn is

- A. N2,100

- B. N2,200

- C. N4,400

- D. N6,400

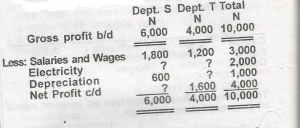

The depreciation to be charged to department T is ?

- A. N30P00

- B. N400

- C. 500

- D. N600

What is the net profit made by department S?

- A. N3,600

- B. N,3000

- C. N2,400

- D. N2,000

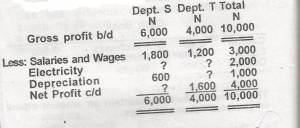

The value of the owner’s equity is

- A. N400,000

- B. N900,000

- C. N957,000

- D. N1,357,000

What is the value of the authorized share capital?

- A. N500,000

- B. N600,000

- C. N750,000

- D. N1, 200,000

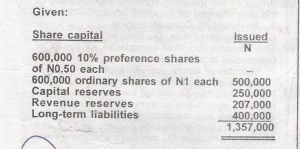

What is the capital at start?

- A. N53 000

- B. N63 000

- C. N73 000

- D. N83 000

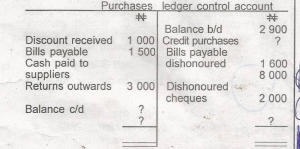

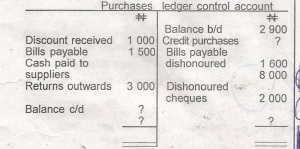

Credit purchases are always put at 150% of the total cash paid to suppliers

Determine the credit purchases

- A. N13 500

- B. N15 500

- C. N13 400

- D. N12 000

Credit purchases are always put at 150% of the total cash paid to suppliers

Calculate the closing balance of the ledger account

- A. N6 900

- B. N6400

- C. N5000

- D. N4000

Use the information to answer this question

Date………….Details……………………

Feb……..1 Purchased 400 units at N1.00 each

,, ……..5 Purchased 200 units at N2.00 each

,,………10 Purchased 200 units at N300 each

,, ………15 Issued 320 units

,,……….20 Issued 200 units at N4,00 each

,,……….25 Issued 120 units

Using the periodic simple average method, the cost per unit is

- A. N4.25

- B. N3.25

- C. N2.25

- D. N1.25

Use the information to answer this question

Date………….Details……………………

Feb……..1 Purchased 400 units at N1.00 each

,, ……..5 Purchased 200 units at N2.00 each

,,………10 Purchased 200 units at N300 each

,, ………15 Issued 320 units

,,……….20 Issued 200 units at N4,00 each

,,……….25 Issued 120 units

Calculate the price per unit of closing stock using the periodic weighted average method.

- A. N3.20

- B. N3.00

- C. N2.20

- D. N2.00

Use the information below to answer this questions

Capital………………N…………N……..

Land and building…….18470……..24000….

Mortgage on premises……………….11090…

Drawings……………3000……………….

Profit and loss……………………3600…

Furniture and fittings…5120……………..

Motor Vehicles………..3462…………….

Closing Stock…………3000…………….

Debtors………………11474……………

Creditors…………………………7354.

Cash…………………1518…………….

……………………..46044………46044

Calculate the value of fixed assets

- A. N15 992

- B. N18 470

- C. N27 000

- D. N27 052

Use the information below to answer this questions

Capital………………N…………N……..

Land and building…….18470……..24000….

Mortgage on premises……………….11090…

Drawings……………3000……………….

Profit and loss……………………3600…

Furniture and fittings…5120……………..

Motor Vehicles………..3462…………….

Closing Stock…………3000…………….

Debtors………………11474……………

Creditors…………………………7354.

Cash…………………1518…………….

……………………..46044………46044

What is the capital employed?

- A. N44 600

- B. N43 052

- C. N43 044

- D. N38 600

What is the consolidated revenue fund balance?

- A. N1100,000

- B. N680,000

- C. N440,000

- D. N410,000

Use the information to answer this question.

…………..ZEBRA PLC…………..

………….Balance sheet as at 31st March, 2002

……………N……………N…………N……

Capital……100,000…Fixed assets:

Current…………….Land &………………

Liabilities………..buildings..50,000……

Creditors……..30000..Furniture..10,000….60,000

…………………..Current………………

…………………..Assets: …….

………………Stock ………30,000………..

………………Debtors…….30,000………….

………………Cash……….10,000……70,000..

………….130,000…………………….130,000

The business was acquired on 1st April, 2002 at a purchase consideration of N120,000 by SOZ. All assets and liabilities were taken over except the cash to open the new firm’s bank account additional N20,000 was paid into the bank.

Calculate the network of the business

- A. N120,000

- B. N90,000

- C. N80,000

- D. N30,000

Use the information to answer this question.

…………..ZEBRA PLC…………..

………….Balance sheet as at 31st March, 2002

……………N……………N…………N……

Capital……100,000…Fixed assets:

Current…………….Land &………………

Liabilities………..buildings..50,000……

Creditors……..30000..Furniture..10,000….60,000

…………………..Current………………

…………………..Assets: …….

………………Stock ………30,000………..

………………Debtors…….30,000………….

………………Cash……….10,000……70,000..

………….130,000…………………….130,000

The business was acquired on 1st April, 2002 at a purchase consideration of N120,000 by SOZ. All assets and liabilities were taken over except the cash to open the new firm’s bank account additional N20,000 was paid into the bank.

The goodwill on purchase is

- A. N90,000

- B. N30,000

- C. N19,000

- D. N18,000

Use the information below to answer question .

Capital ……………….N2000

Bank ………………….N1200

Purchase ………………N2500

Sales …………………N6700

Stock …………………N1300

Creditors ……………..N1000

Fixed assets……………N3700

Drawings ………………N?

Drawings are always estimated at 50% of capital.

Compute the amount withdrawn

- A. N2000

- B. N1500

- C. N1250

- D. N1000

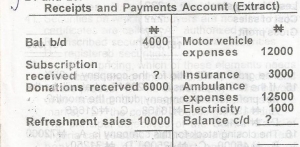

Subscriptions received are always put at 125% of the total donations received and refreshment sales.

Compute the subscriptions received.

- A. N30000

- B. N28000

- C. N24000

- D. N20000