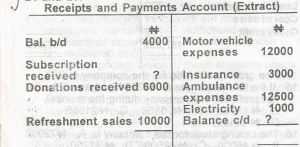

Subscriptions received are always put at 125% of the total donations received and refreshment sales.

What is the closing cash balance ?

- A. N11500

- B. N12000

- C. N13000

- D. N13500

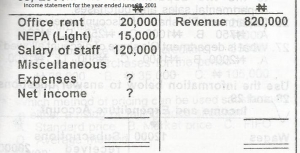

Miscellaneous expense is 10% of revenue Calculate the net income.

- A. N583,000

- B. N563,000

- C. N483,000

- D. N581,000

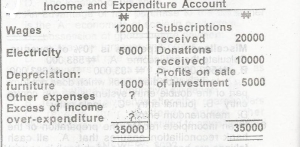

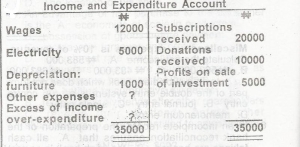

It is the tradition of the club to write off an amount equal to 25% of the subscriptions received as other expenses.

Determine the club’s excess of income over expenditure

- A. N12000

- B. N15000

- C. N10000

- D. N14500

It is the tradition of the club to write off an amount equal to 25% of the subscriptions received as other expenses.

What is the amount to be written off as other expenses?

- A. N4500

- B. N6000

- C. N4000

- D. N5000

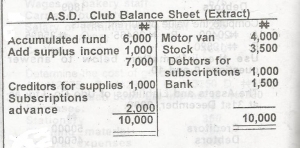

The working capital of the club is

- A. N5000

- B. N4000

- C. N3000

- D. N7000

Use the information below to answer this question.

………….Total……… Dept.P………….Dept.Q

……………N……………N……………..N

Sales………10000…………6000…………..4000

Purchases……4000…………1000…………..3000

Discount received.1000……….?………………

Discounts allowed..2000………………………?.

Discount (allowed and received) are apportioned to the two departments on the basis of departmental sales and purchases.

What is department Q’s share of discount allowed?

- A. N2000

- B. N1500

- C. N800

- D. N1200

Use the information below to answer this question.

………….Total……… Dept.P………….Dept.Q

……………N……………N……………..N

Sales………10000…………6000…………..4000

Purchases……4000…………1000…………..3000

Discount received.1000……….?………………

Discounts allowed..2000………………………?.

Discount (allowed and received) are apportioned to the two departments on the basis of departmental sales and purchases.

Department P’s share of discount received is

- A. N750

- B. N1000

- C. N250

- D. N500

The gross profit on manufactured goods is the difference between the cost of goods manufactured and the

- A. market value of goods produced

- B. prime cost of production

- C. indirect cost of production

- D. goods produced.

Use the information below to answer this question

The partnership agreement between Abba, Baba and Kaka contains the following provision:

(i) 5% interest to be paid on capital and no interest to be charged on drawings

(ii) Profits and losses to be shared in the ratio 3:2:1 respectively

(iii) net profit as at 31/12/95 N 2,250.

……………..Abba……Baba…….Kake

Capital……….5000……4000……3000

Current account…250……100…….175

Salary…………300……300…….—

Drawings……….600……500……..250

Current account balance of Kaka at the end of the year will be

- A. N250

- B. N350

- C. N175

- D. N325

Use the information below to answer this question

The partnership agreement between Abba, Baba and Kaka contains the following provision:

(i) 5% interest to be paid on capital and no interest to be charged on drawings

(ii) Profits and losses to be shared in the ratio 3:2:1 respectively

(iii) net profit as at 31/12/95 N 2,250.

……………..Abba……Baba…….Kake

Capital……….5000……4000……3000

Current account…250……100…….175

Salary…………300……300…….—

Drawings……….600……500……..250

Abba’s capital balance at the end of the year will be

- A. N5475

- B. N5725

- C. N4400

- D. N5000

Use the information below to answer this question

Date………….QTY. …..RATE……..TOTAL

……………(Units)…..N………..N

January 2nd…..500……..25……….12500

March 7th…….250……..28……….7000

Issues were made as follows:

Date…………QTY. (uNITS)

January 9th …..200

February 14th …200

March 11th ……200

The value of closing stock as at February 14th by simple average method is

- A. N3900

- B. N2500

- C. N4100

- D. N2700

Use the information below to answer this question

Date………….QTY. …..RATE……..TOTAL

……………(Units)…..N………..N

January 2nd…..500……..25……….12500

March 7th…….250……..28……….7000

Issues were made as follows:

Date…………QTY. (uNITS)

January 9th …..200

February 14th …200

March 11th ……200

The closing stock on March 11th by LIFO valuation is

- A. N4200

- B. N2700

- C. N4500

- D. N3900

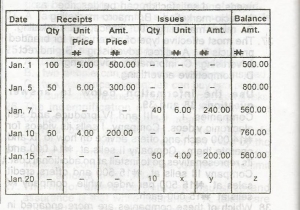

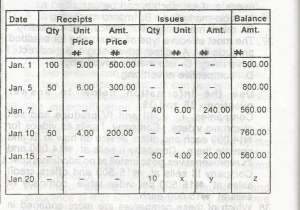

WHAT IS THE STOCK VALUATION METHOD USED?

- A. LAST IN FIRST OUT

- B. FIRST IN FIRST OUT

- C. AVERAGE COST

- D. WEIGHTED AVERAGE

Given:

N N

Capital 200,000 total assets 210,000

Liabilities 10,000

210,000 210,000

If the business is purchased at a price including a goodwill of N 20,000, what must have been the purchas price?

- A. N190,000

- B. N210,000

- C. N220,000

- D. N230,000

» Given:

PTF Trial Balance [Extract] as at 31 December, 1999

Dr Cr

N’000 N ‘000

Cash 2,000

Investments 3,000

Accounts receivable 6,000 11,000

Fund balance 11,000 11,000

If only 1/2 of the investments is sold for N2m and N5m realized from the accounts receivable what will be the balance of the fund?

- A. N9M

- B. N11M

- C. N13M

- D. N16M

Given:

PTF Trial Balance [Extract] as at 31 December, 1999

Dr Cr

N’000 N ‘000

Cash 2,000

Investments 3,000

Accounts receivable 6,000 11,000

Fund balance 11,000 11,000

Assuming all the investments realized N4m, what will be the endig fund balance?

- A. N8m

- B. N 11M

- C. N12M

- D. N15M

» Given:

Authorized Capital: N

100,000 ordinary shares of N 1 eash

Issued and fully paid:

50,000 ordinary shares of N 1 each 50,000

10, 000 8% perference shares

of N 1 each

Reserves 10,000

Creditors 25,000

Debtors 13 000

Cash in hand 5000

Calculate the shareholders fund

- A. N 60,000

- B. N75,000

- C. N85,000

- D. N185,000

Given:

Authorized Capital: N

100,000 ordinary shares of N 1 eash

Issued and fully paid:

50,000 ordinary shares of N 1 each 50,000

10, 000 8% perference shares

of N 1 each

Reserves 10,000

Creditors 25,000

Debtors 13 000

Cash in hand 5000

Determine the net current assets

- A. N 43,000

- B. N 28,000

- C. N13,000

- D. N3,000

Use the information below to answer question

Given: 31/12/98 31/12/99

Assets: Plant and Mach. N1,500 N1,200

Fixtures N700 N520

Stock N500 N600

Debtors N900 N400

Cash N200 N300

Liabilities: Creditor N500 N600

Loan N600 N400

What is the capital from the opening balance sheet?

- A. N3,600

- B. N 2,700

- C. N2,070

- D. N1,520

Given

Dept A Dept B

Floor space 40m2 60m2

Machine hours 1200 1400

Turnover N36 million N64 million

Labour hours 1000 1400

A joint cost of N 72 million incurred by the two departments was apportioned N30 million to A and N42 million to B. the basis used for apportionment must have been

- A. labour hours

- B. floor space

- C. turnover

- D. machine hours