A company has 5% debentures worth N500 000 ordinary share capital N 2 000 000, and preference shares N1500 000. if the company made a profit of N 1 000 000, the debenture interest would amount to

- A. N 1 000 000

- B. N 500 000

- C. N 50 000

- D. N 25 000

On partnership dissolution, if a partner’s capital account has a debit balance and the partnr is insolvent, the deficiency will, in accordance with the decision of the case of Garner v Murray, be

- A. borne by all the partners

- B. borne by the insolvent partner

- C. written off

- D. borne by the solvent partners

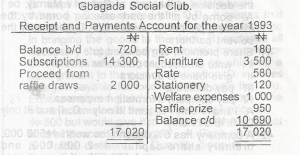

Accumulated fund on 1st January 1993 is

- A. N 8 570

- B. N8 470

- C. N 850

- D. N7 520

Additional information :

1: 1: 93 31 : 12 : 93

N N

Subscription in arrears 300 450

Furniture 7000

Subscription received

in advance 500 400

Rate owing 50 60

Subscription relating to the accounting year 1993 in the income and expenditure account is

- A. N 15 050

- B. N 14 550

- C. N14 300

- D. N 13 400

An income and expenditure account is a summary of

- A. all income and expenditure during a period

- B. revenue income and expenditure during a period

- C. receipts and payments during a period

- D. the trading income a period

The difference between a trading account and a manufacturing account is that while the manufacturing account

- A. has no particular period, the trading account has

- B. does not consider the cost of goods involved, the trading account does

- C. is concerned with the cost of production, the trading account is not

- D. is not concerned with the stock of raw materials the rading account is

Given: N

Direct material – 10 000

Direct labour – 5000

Direct expenses – 2000

Factory overhead – 4000

What is the prime cost?

- A. N21 000

- B. N 17 000

- C. N 15 000

- D. N 6 000

In analyzing incomplete records, which of the following should be investigated?

- A. the general ledger

- B. the purchases day book and sales day book

- C. the nature of trading activities and the basis on which goods are sold

- D. the asset register together with the depreciation schedule

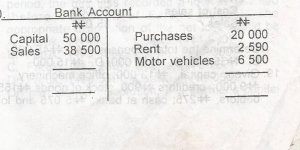

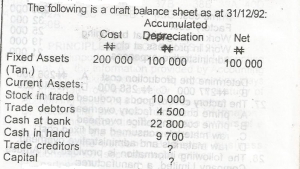

What is the balance of the bank account shown above?

- A. N88 500 debit

- B. N 88 500 credit

- C. N 59 410 credit

- D. N 59 410 debit

The trial balance showed wages, N2 500 and a note stated that N500 wages, were due but unpaid when preparing final accounts and loss account with

- A. N 3000 and show wages accrued N 500 in the balance sheet in the balance sheet

- B. N 2 000 and show wages accured N500 in the balance sheet

- C. N 3000 and show wages prepaid N 500 in the balance sheet

- D. N 2000 and show wages paid in advance N 500 in the balance sheet

What was the balance showed wages, N2 500 and a note stated that N 500 wages were due but unpaid when preparing final accounts and loss account with

- A. N 3 000 and show wages accrued N 500 in the balance sheet

- B. N2 000 and show wages accrued N500 in the balance sheet

- C. N 3 000 and show wages perpaid N 500 in the balance sheet

- D. N 2000 and show wages paid in advance N500 in the balace sheet

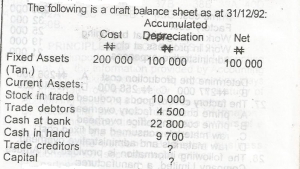

Trade creditors account was maintained at 25% of the capital.

What was the balance in the trade creditors account as at 31/12/92?

- A. N 29 800

- B. N 29 500

- C. N29 400

- D. N 29 000

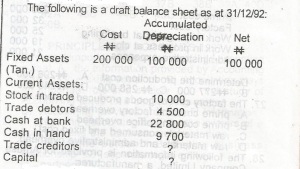

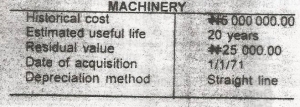

THE BOOK VALUE OF THE ASSET AS AT 31/12/86 WAS

- A. N 3 731 250.00

- B. N 2 487 500.00

- C. N 1 268 750.00

- D. N1 020 000. 00

Accumulated depreciation on the asset as at 31/12/81 was

- A. N 2 487 500 .00

- B. N 2 736 250 . 00

- C. N 4 511 192.00

- D. N 4 975 000 .00

A charitable club has the following figures:

N

Subscriptions received in 1991 2 800

Subscriptions unpaid in 1990 300

Subscriptions paid for 1992 150

Subscriptions due 1991 180

How much should be charged to the income and expenditure of this club as subscription for 1991?

- A. N 2 530

- B. N 2 680

- C. N 2 830

- D. N 2 980

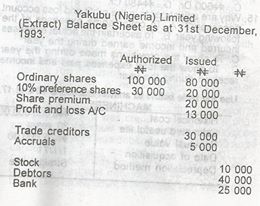

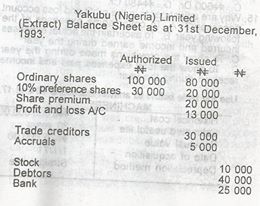

If a 10% dividend is approved, what is the dividend payable to ordinary shareholders?

- A. N 13 000

- B. N 11 300

- C. N 10 000

- D. N 8 000

Equity shareholders’ fund is

- A. N133 000

- B. N 120 000

- C. N113 000

- D. N 100 000

The purpose of a trading account is to ascertain

- A. sales

- B. carriage outwards

- C. gross profit or loss

- D. net profit or loss

The accounting concepts which assumes that business will continue to be in existence into the foresee ablefure is

- A. periodicity

- B. business entity

- C. dual aspect

- D. going concern

Which of the following is not a feature of accounting information?

- A. timeliness

- B. accuracy

- C. completeness

- D. affordability

Capital reserves includes the following except

- A. revaluation surplus

- B. pre-incoporation profit

- C. share premium

- D. general reserves