ANWSER

—

Question 1:

What are farm records?

Answer:

Farm records are systematic documentation of all activities taking place in a farm enterprise over a given period of time. They involve recording daily operations, transactions, and production processes to monitor and evaluate the farm’s performance. Farm records help in identifying problems, making corrective measures, and assessing the financial and operational health of the farm. Examples include resource inventories, production accounts, and income/expense records.

—

Question 2:

List and explain the various farm records a farmer is expected to keep on his farm.

Answer:

Farmers are expected to keep the following types of records:

1. Resource Inventories: Records of assets like land, machinery, livestock, and liabilities. These help in valuing resources and preparing balance sheets.

2. Production Accounts: Records of crop yields, livestock performance, feed usage, and labor. These monitor efficiency and productivity.

3. Income and Expense Records: Financial transactions, including sales, purchases, and operational costs. These are used to prepare income statements and cash flow analyses.

—

Question 3:

List and explain the principles guiding the keeping of good farm records.

Answer:

The principles of good farm record keeping include:

1. Accuracy: Records must be precise and filled promptly after transactions.

2. Regular Comparison: Compare results with past records or other farms to identify trends or issues.

3. Organization: The system should align with the farm’s structure and operations.

4. Consistency: Develop a habit of regular and accurate record posting.

5. Bank Reconciliation: Conduct financial transactions through banks and reconcile statements monthly.

—

Question 4:

State and explain the various types of farm records.

Answer:

The three basic types of farm records are:

1. Resource Inventories: Track assets (land, machinery) and liabilities (debts).

2. Production Accounts: Record crop yields, livestock performance, and labor usage.

3. Income and Expense Records: Document financial transactions to assess profitability.

—

Question 5:

State and explain the various uses of farm records.

Answer:

Farm records are used to:

1. Evaluate Performance: Compare current and past results to assess progress.

2. Financial Planning: Provide data for budgeting and cash flow management.

3. Decision-Making: Identify strengths/weaknesses and guide operational changes.

4. Compliance: Assist in tax preparation and loan applications.

—

Question 6:

Differentiate between record keeping and record analysis.

Answer:

– Record Keeping: Involves documenting farm activities (e.g., transactions, production data) systematically.

– Record Analysis: Evaluates the recorded data to derive insights, such as profitability or efficiency, for informed decision-making.

—

Question 7:

Compare and contrast the hand system and computerized system of record keeping.

Answer:

– Hand System:

– Pros: Low cost, easy to implement.

– Cons: Time-consuming, prone to errors, limited analysis capabilities.

– Computerized System:

– Pros: Fast, accurate, enables advanced analysis and reporting.

– Cons: Higher initial cost, requires technical knowledge.

—

Question 8:

Define bookkeeping and accounting.

Answer:

– Bookkeeping: The mechanical process of recording financial transactions (e.g., sales, purchases) systematically.

– Accounting: Broader scope includes designing systems, preparing financial statements, audits, and analysis to aid decision-making.

—

Question 9:

Distinguish between bookkeeping and accounting.

Answer:

– Bookkeeping is transactional (recording data), while accounting is analytical (interpreting data for decisions).

– Bookkeeping is a subset of accounting, which also includes forecasting, audits, and tax work.

—

Question 10:

Explain the three major divisions of books used in bookkeeping and accounting.

Answer:

1. Principal Books: Ledger and cash book (main records).

2. Subsidiary Books: Original entry books (e.g., sales/purchase journals).

3. Statistical Books: Supplementary records (e.g., stock registers).

—

Question 11:

Who is a bookkeeper?

Answer:

A bookkeeper is a professional responsible for recording daily financial transactions (e.g., sales, purchases) in daybooks and ledgers. They ensure accuracy and bring books to the trial balance stage for accountants to prepare financial statements.

—

Question 12:

State and explain the major methods of bookkeeping.

Answer:

1. Single-Entry System: Records only cash transactions (simple but incomplete).

2. Double-Entry System: Records dual aspects (debit/credit) for accuracy and completeness.

—

Question 13:

What are the basic things to consider in selecting a computer record-keeping system?

Answer:

Consider:

1. Farm Size/Debt Level: Larger farms may need advanced systems.

2. Accounting Knowledge: Some software requires expertise.

3. Features Needed: Enterprise accounting, payroll, or production tracking.

4. Cost vs. Benefit: Balance functionality with budget.

—

Question 14:

Which computer software would you recommend as the best for farm business?

Answer:

For comprehensive needs: Farm Cash/Accrual Systems (e.g., PCMars, RedWing). For simplicity: Quicken (cash-based) or QuickBooks (general accounting). The best choice depends on farm size, debt, and required features.

—

Question 1:

What is the result when opening stock and purchases are added together, and what is the resulting figure when closing stock is deducted?

Answer:

When opening stock and purchases are added together, the result is the cost of goods available for sale. When closing stock is deducted, the resulting figure is the cost of goods sold.

—

Question 2:

How is the value of sales in a period determined using the Sales Control Account?

Answer:

The value of sales in the period is determined by the difference between the debit and credit sides of the Sales Control Account. The debit side includes the opening value of debtors, while the credit side includes cash received from debtors and the closing value of debtors.

—

Question 3:

How is the value of purchases in a period determined using the Purchases Control Account?

Answer:

The value of purchases is the difference between the debit and credit sides of the Purchases Control Account. The debit side includes cash paid to creditors, and the credit side includes the opening value of creditors.

—

Question 4:

What is the purpose of subsidiary books in accounting?

Answer:

Subsidiary books serve the following purposes:

1. Provide a systematic and complete record of financial transactions.

2. Classify transactions (e.g., purchases, sales) to avoid errors or omissions.

3. Simplify posting to the ledger by summarizing transactions periodically.

4. Include books like Purchases Journal, Sales Journal, Purchases Returns Book, and Sales Returns Book.

—

Question 5:

What is the role of the Journal Proper?

Answer:

The Journal Proper is used to record transactions that cannot be entered in other subsidiary books, such as:

– Opening and closing entries.

– Correction of errors.

– Transfer of items between accounts.

– Unique or non-routine transactions.

—

Question 6:

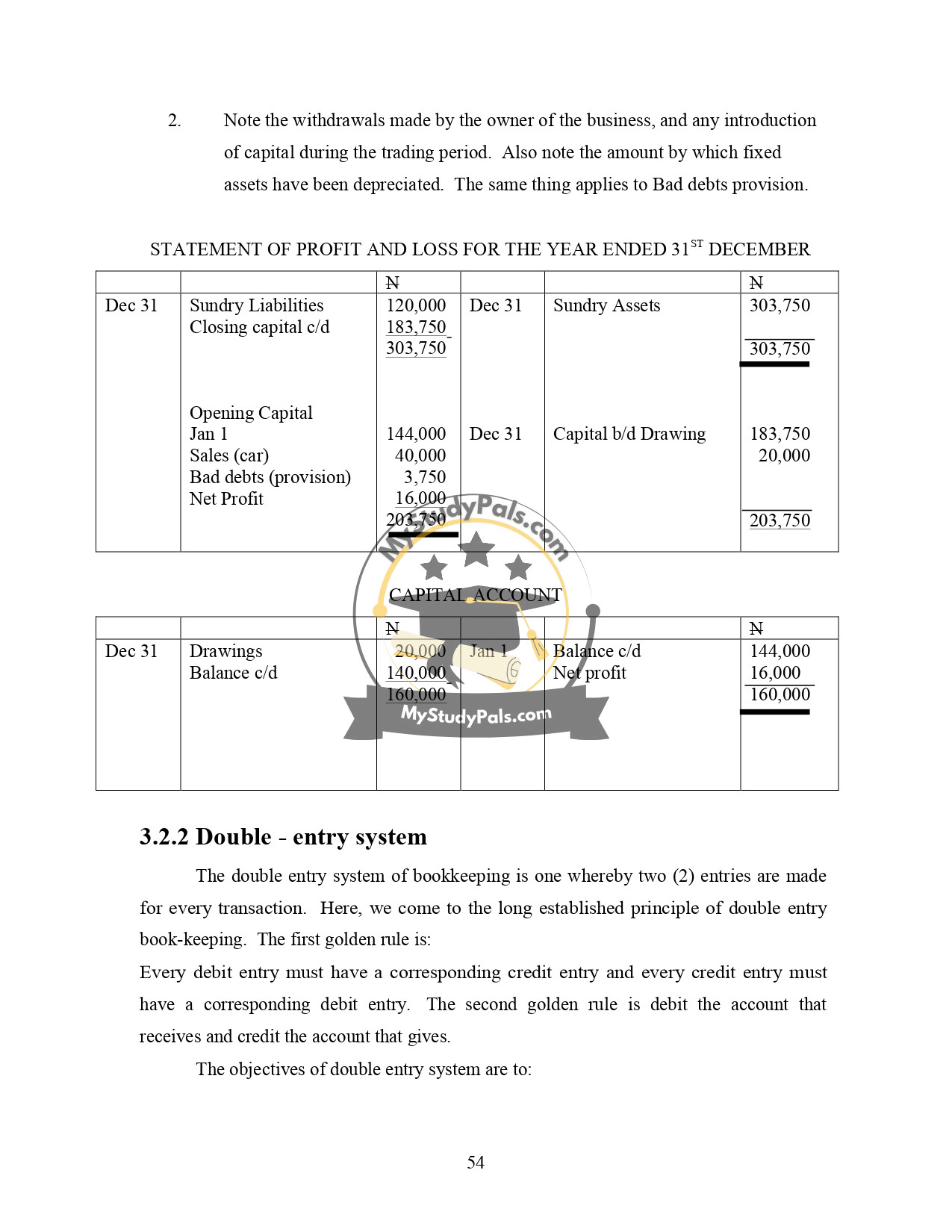

How is the closing capital ascertained in the Statement of Affairs?

Answer:

Closing capital is calculated as the difference between total assets and total liabilities listed in the Statement of Affairs. For example:

– Total Assets: Machinery, Furniture, Stock, Debtors, Cash, etc.

– Total Liabilities: Creditors, Rent Owing, Bills Payable, etc.

– Closing Capital = Total Assets − Total Liabilities.

—

Question 7:

What are the steps to prepare a Statement of Profit?

Answer:

1. Determine the opening capital from the initial Statement of Affairs.

2. Ascertain the closing capital (assets minus liabilities at year-end).

3. Adjust for additional capital introduced or drawings during the period.

4. The profit/loss is the difference between adjusted closing capital and opening capital.

—

Question 8:

List the types of accounts in a ledger with examples.

Answer:

1. Personal Accounts:

– Debtors (e.g., customers).

– Creditors (e.g., suppliers).

2. Impersonal Accounts:

– Real Accounts: Property (e.g., Machinery, Stock).

– Nominal Accounts: Income/Expenses (e.g., Sales, Wages).

—

Question 9:

How are purchases returns recorded in the Purchases Returns Book?

Answer:

Purchases returns are recorded by:

1. Listing details (date, supplier name, goods returned).

2. Posting individual entries to the supplier’s account (debit).

3. Posting the periodic total to the Purchases Returns Account (credit).

—

Question 10:

What transactions are recorded in the Cash Account for L. Oladimeji in January?

Answer:

Cash Account Entries:

– Debit: Capital (N200,000), Office Furniture sold (N70,000), Sales (N150,000).

– Credit: Motor van (N100,000), Rent (N10,000), Drawings (N15,000).

—