ANWSER

—

Question One

(a) Assumptions underlying capital structure theories:

1. No Taxes: Assumes no corporate or personal taxes, implying no tax shield on interest payments.

2. Perfect Capital Markets: No transaction costs, bankruptcy costs, or asymmetric information.

3. Fixed Investment Policy: The firm’s investment decisions are independent of its financing decisions.

4. Homogeneous Expectations: All investors have the same expectations about future earnings and risks.

5. No Dividend Payout: All earnings are retained, and no dividends are paid.

(b) Falope Limited (Net Income Approach):

(i)

– Value of Equity (E) = Net Income / Cost of Equity = ¥300,000 / 0.14 = ¥2,142,857.

– Value of Firm (V) = E + Debt = ¥2,142,857 + ¥750,000 = ¥2,892,857.

– Overall Cost of Capital (Ko) = EBIT / V = ¥300,000 / ¥2,892,857 ≈ 10.37%.

(ii)

– If debt increases to ¥1,000,000, equity remains ¥2,142,857 (assuming no change in NI).

– New V = ¥2,142,857 + ¥1,000,000 = ¥3,142,857.

(c) ABC Ltd. (Traditional Approach):

– Objective: Maximize EPS.

– Options:

1. Debt ¥300,000 (8%) + Equity ¥2,700,000:

– Interest = ¥24,000; EBIT = ¥500,000; EBT = ¥476,000; Tax (40%) = ¥190,400.

– Net Income = ¥285,600; Shares = ¥2,700,000 / ¥250 = 10,800.

– EPS = ¥285,600 / 10,800 ≈ ¥26.44.

2. Debt ¥1,000,000 (10%) + Equity ¥2,000,000:

– Interest = ¥100,000; EBT = ¥400,000; Tax = ¥160,000.

– Net Income = ¥240,000; Shares = 8,000.

– EPS = ¥30.00.

3. Debt ¥1,500,000 (15%) + Equity ¥1,500,000:

– Interest = ¥225,000; EBT = ¥275,000; Tax = ¥110,000.

– Net Income = ¥165,000; Shares = 6,000.

– EPS = ¥27.50.

– Advice: Choose Option 2 (Debt ¥1,000,000) for highest EPS (¥30.00).

(d) Philip Limited (Net Operating Income Approach):

(i)

– Value of Firm (V) = EBIT / Ko = ¥300,000 / 0.20 = ¥1,500,000.

– Value of Equity (E) = V – Debt = ¥1,500,000 – ¥750,000 = ¥750,000.

– Cost of Equity (Ke) = (EBIT – Interest) / E = (¥300,000 – ¥90,000) / ¥750,000 = 28%.

(ii)

– If debt increases to ¥900,000:

– V remains ¥1,500,000 (NOI approach assumes V is constant).

– New E = ¥1,500,000 – ¥900,000 = ¥600,000.

– New Ke = (¥300,000 – ¥108,000) / ¥600,000 = 32%.

—

Question Two

(a) Elements of Cost of Capital:

1. Cost of Debt: After-tax interest rate on borrowed funds.

2. Cost of Equity: Return required by shareholders (e.g., via CAPM or Dividend Growth Model).

3. Cost of Preferred Stock: Dividend yield on preferred shares.

(b) Limitations of CAPM:

1. Assumes perfect markets (no taxes, transaction costs).

2. Relies on historical beta, which may not predict future risk.

3. Ignores unsystematic risk (firm-specific factors).

(c) Alake Limited (Cost of Debt):

(i) After-tax cost = 15% × (1 – 0.30) = 10.5%.

(ii) With 10% flotation cost:

– Net proceeds = ¥150,000 × 0.90 = ¥135,000.

– After-tax cost = (¥22,500 + (¥150,000 – ¥135,000)/5) / ¥135,000 ≈ 12.22%.

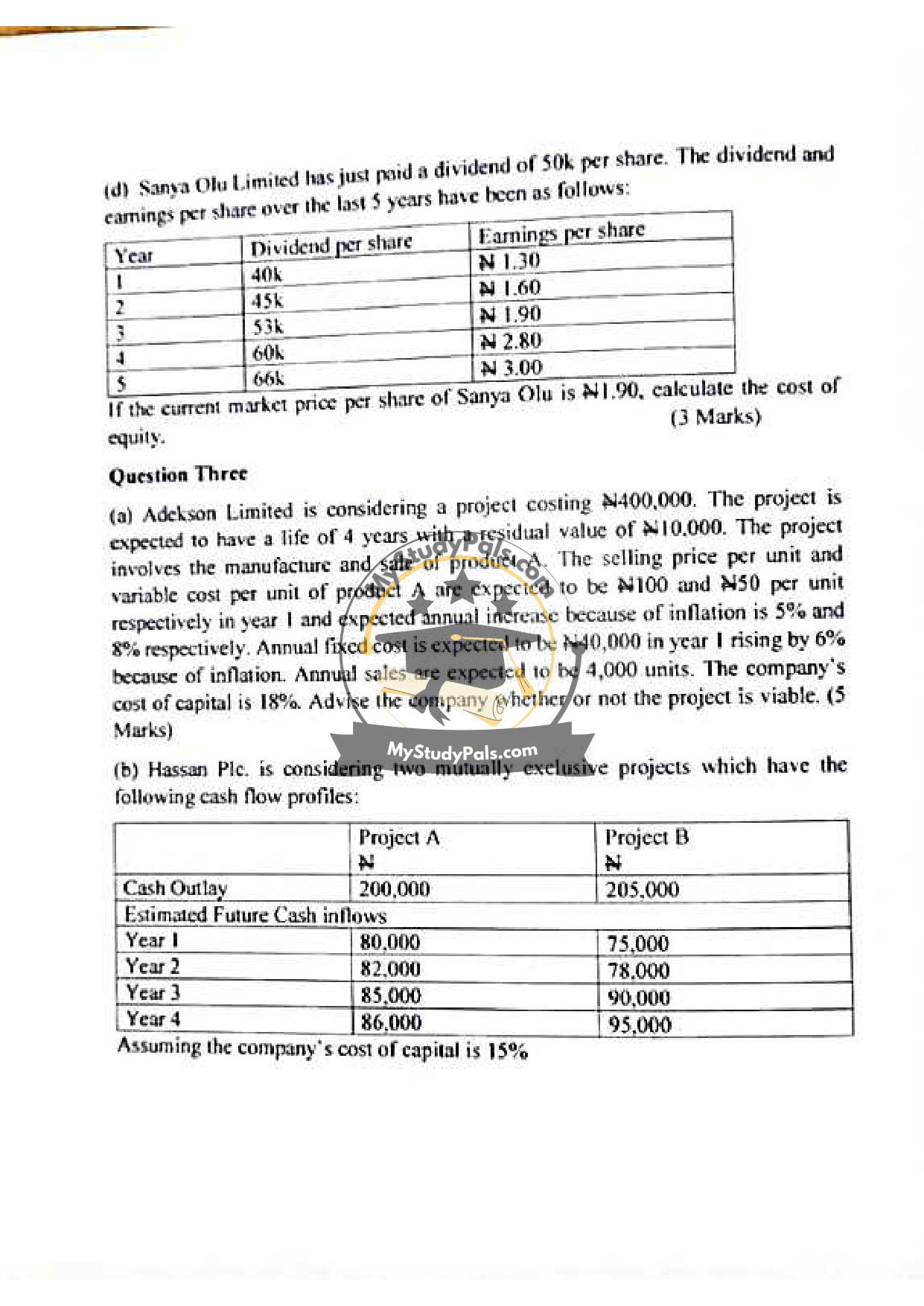

(d) Sanya Olu Limited (Cost of Equity):

– Use Dividend Growth Model:

– Growth rate (g) = (66k/40k)^(1/5) – 1 ≈ 10.5%.

– Ke = (D1 / P0) + g = (66k × 1.105 / ¥1.90) + 0.105 ≈ 48.3%.

—

Question Three

(a) Adelson Limited (Project Viability):

– NPV Calculation:

– Annual cash flows adjust for inflation (e.g., Year 1: (100 – 50) × 4,000 – 40,000 = ¥160,000).

– Discount at 18%: NPV ≈ ¥160,000/(1.18) + … – ¥400,000.

– If NPV > 0, accept.

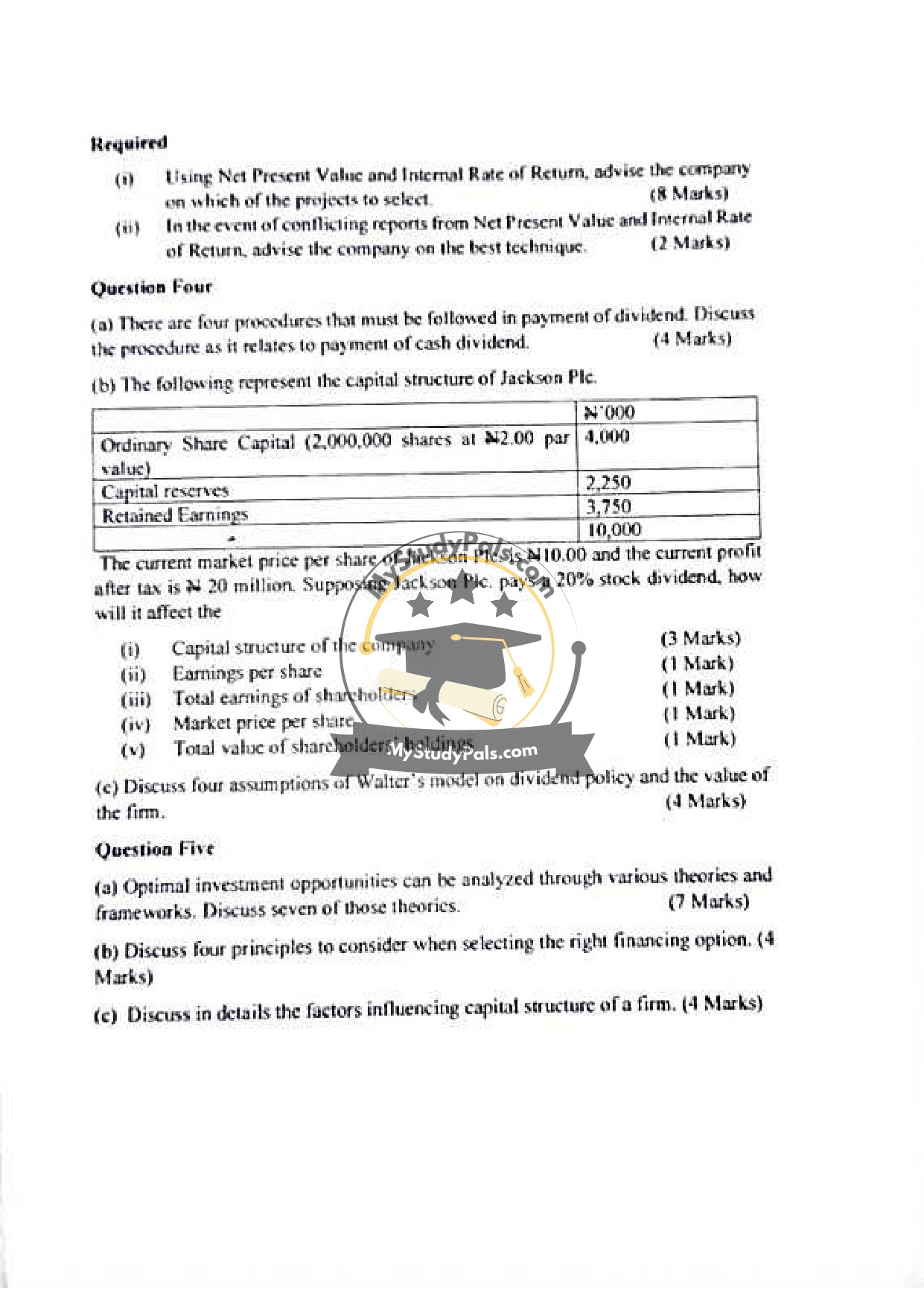

(b) Hassan Plc. (NPV vs. IRR):

(i)

– Project A NPV: ¥80,000/(1.15) + ¥82,000/(1.15)^2 + … – ¥200,000 ≈ Positive.

– Project B NPV: Higher NPV → Choose B.

– IRR: Project B’s IRR > 15% → Choose B.

(ii) Prefer NPV (reinvests at cost of capital; avoids IRR’s multiple rates issue).

—

Question Four

(a) Dividend Payment Procedures:

1. Declaration Date: Board announces dividend.

2. Record Date: Shareholders registered by this date receive dividend.

3. Ex-Dividend Date: Shares traded without dividend entitlement.

4. Payment Date: Dividend is paid to shareholders.

(b) Jackson Plc. (Stock Dividend Impact):

(i) Capital reserves decrease; ordinary share capital increases.

(ii) EPS decreases (more shares outstanding).

(iii) Unchanged (total earnings remain ¥20 million).

(iv) Market price per share drops (e.g., ¥10 → ~¥8.33).

(v) Unchanged (value adjusts proportionally).

(c) Walter’s Model Assumptions:

1. All financing is via retained earnings.

2. Constant return (r) and cost of capital (Ke).

3. Infinite life of the firm.

4. No taxes or flotation costs.

—

Question Five

(a) Investment Theories:

1. Net Present Value (NPV)

2. Internal Rate of Return (IRR)

3. Payback Period

4. Profitability Index

5. Modigliani-Miller Theorem

6. Pecking Order Theory

7. Agency Cost Theory

(b) Financing Principles:

1. Match financing duration with asset life.

2. Minimize cost of capital.

3. Maintain financial flexibility.

4. Consider tax implications.

(c) Capital Structure Factors:

1. Tax Shield: Benefit from debt interest deductions.

2. Business Risk: Volatility of earnings.

3. Financial Flexibility: Ability to raise funds quickly.

4. Market Conditions: Interest rates and investor sentiment.

—